Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

QQQ vs VOO: Which ETF Can Take Your $100,000 to New Heights?

When it comes to investing, choosing the right ETF can feel overwhelming, especially if you’re aiming for a huge return on your investment. Could your $100,000 turn into $10 million? It may sound impossible, but the right choice of ETF could make that dream a reality. In this article, we’re going to compare two of the most popular ETFs: VOO (Vanguard S&P 500 ETF) QQQ (Invesco QQQ Trust), analyzing everything from performance to risk, expense ratios, and more, so you can decide which one will be the best fit for your financial journey.

What Are VOO and QQQ?

Before diving into the specifics, let’s start with the basics of what these two powerhouse funds represent.

VOO is Vanguard’s S&P 500 ETF, launched in 2010, and it aims to track the performance of the S&P 500 Index. This index serves as a benchmark for the U.S. stock market, comprising the 500 largest companies across various sectors. If you’re looking for diversification and stable long-term growth, VOO is a great choice. For a deeper dive into VOO’s dividend structure and how it can complement your investment strategy, check out our detailed guide on VOO Dividends.

QQQ, on the other hand, tracks the NASDAQ 100 Index. With its focus primarily on technology and growth companies like Apple, Microsoft, and Amazon, QQQ is ideal for investors seeking exposure to high-growth sectors. It was launched in 1999 and has since become a favorite among investors who want to tap into the innovation-driven potential of tech.

Expense Ratios: A Key Factor

One of the first things you’ll notice when comparing these two ETFs is their expense ratios. VOO offers an incredibly low expense ratio of 0.03%, meaning you only pay $3 for every $10,000 invested. This makes it a budget-friendly choice for passive investors.

In contrast, QQQ has a higher expense ratio of 0.20%, which might not sound like a lot but can add up to $20 per $10,000 invested. Though the difference might seem small, over the long run, it could significantly impact your returns. For instance, a $100,000 investment in VOO costs just $30 annually, whereas the same amount in QQQ would cost $200.

Diversification: The Strength of VOO vs. The Focus of QQQ

When it comes to diversification, VOO has a distinct advantage. With 500 holdings spread across various sectors, it offers broad market exposure, including industries like healthcare, consumer goods, and financials. The S&P 500 index is well-known for providing balanced risk and reward.

QQQ, on the other hand, is much more concentrated, holding around 100 stocks. It’s heavily weighted in technology, which means you’re more exposed to the performance of companies like Apple, Microsoft, and Nvidia. This concentration can lead to higher volatility, but it also opens the door to potentially higher returns, especially during tech booms.

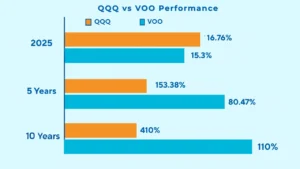

Performance: A Side-by-Side Look

Now, let’s break down how VOO vs QQQ stacks up over the long term.

- Short-Term (2025): As of this year, VOO has achieved a 15.3% return, slightly trailing QQQ at 16.76%. This shows that, in the short run, QQQ has a slight edge, primarily due to its tech-heavy focus.

- 5-Year Performance: Looking back over the past five years, QQQ has returned an impressive 153.38%, significantly outperforming VOO’s 80.47%. This highlights QQQ’s advantage during periods of tech-driven growth.

- 10-Year Performance: The story gets even more compelling when we extend the timeline to 10 years. Over this period, QQQ has posted a jaw-dropping 410% return, while VOO has delivered around 180%. If you’re after massive growth and can handle volatility, QQQ has outperformed.

However, this doesn’t mean that VOO is a slouch. For those seeking steady, reliable growth with lower risk, VOO’s broad market exposure and stability make it a strong contender.

Risk: Can You Handle the Volatility?

Risk is an essential factor to consider when investing, and here’s where the two ETFs differ significantly.

- VOO offers stability and lower volatility, which makes it more suitable for conservative investors. Its broad diversification across sectors provides a cushion against market downturns.

- QQQ, while more volatile, presents higher growth potential. The tech-heavy focus means it can deliver massive returns in periods of strong market growth, but it also has sharper declines during market corrections. For example, during the 2022 market crash, QQQ experienced a 30% drop, compared to VOO’s 18% drop.

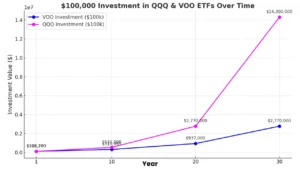

Long-Term Growth: A $100,000 Investment in Both ETFs

Let’s look at the power of compounding for each ETF. Imagine investing $100,000 in both VOO and QQQ today.

With VOO

- : 1 Year: The investment grows to $112,200.

- 10 Years: Your investment triples to $310,995.

- 20 Years: The value grows to approximately $937,000.

- 30 Years: The investment could reach $2.77 million

With QQQ

- 1 Year: Your investment grows to $108,130.

- 10 Years: It grows fivefold to $531,000.

- 20 Years: The investment balloons to $2.77 million.

- 30 Years: Your initial investment could soar to a staggering $14.3 million.

As you can see, QQQ’s higher growth potential comes with higher volatility. However, it could lead to impressive results over the long run.

Which ETF is Better for You?

The choice between VOO and QQQ ultimately depends on your investment goals and risk tolerance.

- VOO is better for those who want steady growth, lower risk, and long-term stability. It’s ideal for people looking to invest in the entire U.S. economy and build a solid, diversified portfolio.

- QQQ is a great choice for growth-focused investors who can tolerate higher volatility in exchange for the potential of massive returns, especially if you believe in the long-term success of technology companies.

Which ETF Should You Choose?

If you’re seeking steady growth, low costs, and minimal risk, VOO is likely the best option for you. It’s a great foundation for long-term investing, and with its broad exposure to various sectors, it offers stability during market fluctuations.

On the other hand, if you’re willing to take on more risk for the possibility of higher returns, QQQ may be the right choice, especially if you’re passionate about technology and growth sectors.

No matter which ETF you choose, remember that the key to successful investing is consistency. By contributing regularly, dollar-cost averaging, and letting your money grow over time, you’ll be well on your way to building wealth. Happy investing!