Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

The First Question Every Investor Asks

Imagine sitting at your desk, calculator in hand, wondering: “How much money would I need in VOO just to live off dividends?” That’s the same curiosity that drives countless new investors toward Vanguard’s S&P 500 ETF — better known by its ticker, VOO.

It’s not just numbers on a screen. It’s the dream of quitting a 9-to-5, of having dividend checks roll in every quarter, and of finally reaching that elusive milestone called financial freedom. But before you can picture yourself sipping coffee on a Tuesday morning while dividends pay your bills, you need to understand the VOO dividend story.

What Is VOO and Why Investors Love It

VOO isn’t just another ETF. It’s Vanguard’s powerhouse fund that mirrors the performance of the S&P 500, giving you a piece of the 500 largest U.S. companies. Think of it as owning a slice of Apple, Microsoft, Amazon, Meta, and hundreds more — without having to pick winners yourself.

Why do investors flock to it? Four reasons keep coming up:

- Diversification across every sector of the U.S. economy.

- Strong historical returns, averaging about 10% annually since 1957.

- Ultra-low fees — just 0.03% expense ratio. That’s $3 per $10,000 invested.

- Quarterly dividends that grow over time.

It’s that last point — dividends — that often sparks the most excitement. Because while market growth is thrilling, dividends feel tangible. They hit your account, they’re real money, and they can be reinvested to accelerate compounding.

How Often Does VOO Pay Dividends?

VOO follows a quarterly schedule, meaning investors get paid four times a year. Payments usually arrive around March, June, September, and December.

But there’s a catch: you need to own the ETF before the ex-dividend date. This date acts as the cutoff — buy after it, and the seller gets the dividend, not you.

For example:

- In 2024, VOO’s ex-dividend date was September 27, with payment landing on October 1.

- The next expected ex-dividend date is approximately December 20, 2024, with payment scheduled to follow a few days later.

This rhythm makes VOO reliable. You can plan around its payouts, whether you’re reinvesting them or using them for income.

What’s the Dividend Yield on VOO?

Here’s where many beginners do a double-take. VOO’s dividend yield is around 1.2–1.3%. That may sound small compared to high-yield dividend stocks. But the truth is more powerful:

- In 2024, the dividend per share was roughly $5.44 annually.

- At a share price of $437, that equals the 1.24% yield.

- Yields shift as share price moves — if price rises, yield looks smaller, but actual dividends still grow.

It’s not the flashy 5% or 6% yields you see elsewhere. But VOO’s strength lies in steady growth plus consistent dividends. Together, they create the snowball effect that long-term investors swear by.

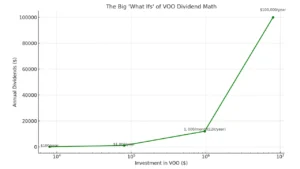

The Big “What Ifs” of Dividend Math

Let’s put real numbers to the dream. Suppose you wanted:

- $100 per year in dividends → You’d need about $8,000 in VOO.

- $1,000 per year → Around $80,000 invested.

- $1,000 per month ($12,000/year) → Roughly $967,000 invested.

- $100,000 per year → A staggering $8 million invested.

At first glance, those numbers can feel discouraging. But here’s the emotional truth: no one starts with millions. Most investors begin with a few hundred dollars a month, then watch compounding and dividends turn that trickle into a river.

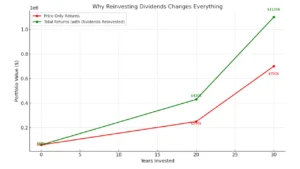

Why Reinvesting Dividends Changes Everything

Think about it. A 1.2% yield may not wow you today. But reinvest those dividends, and over decades, the difference becomes life-changing.

For example:

- $60,000 invested in VOO at an average 10.4% return → grows to $430,000 in 20 years.

- Hold for 30 years → that same $60,000 blossoms into $1.1 million.

he gap between “price only returns” and “total returns with reinvested dividends” widens dramatically with time. That’s why seasoned investors often say: “Don’t sleep on dividends — they’re your quiet wealth builder.”

Real Stories of Milestones

Many investors celebrate milestones like $50,000 or $100,000 in VOO. Why? Because those amounts act like a psychological turning point.

- At $50,000 invested, you’re not just dabbling — you’re building a serious base. Left untouched for 35 years, that alone could turn into $1.7 million.

- At $100,000 invested, even if you stopped contributing, compounding could carry it to over $5 million in 40 years.

These milestones prove that you don’t need to “time the market.” You need to spend time in the market.

Three Keys to Dividend Success with VOO

If you want to maximize VOO’s potential, here are the three principles echoed by nearly every long-term investor:

- Stay invested through ups and downs. Don’t panic sell when markets dip — history shows recovery always comes.

- Automate with dollar-cost averaging. Invest weekly or monthly to remove emotion and build consistency.

- Use tax-advantaged accounts. A Roth IRA, for instance, lets your VOO dividends grow tax-free, and withdrawals in retirement are tax-free too.

Emotional Side of VOO Investing

VOO is about math, compounding, and data. But beneath those charts lies something emotional: hope. Hope that consistent investing can buy back your time, provide for your family, and grant freedom from financial stress.

Whether you’re starting with $100 a month or aiming for millionaire milestones, VOO isn’t just an ETF. It’s a long-term partner in building wealth.

[…] VOO is Vanguard’s S&P 500 ETF, launched in 2010, and it aims to track the performance of the S&P 500 Index. This index serves as a benchmark for the U.S. stock market, comprising the 500 largest companies across various sectors. If you’re looking for diversification and stable long-term growth, VOO is a great choice. For a deeper dive into VOO’s dividend structure and how it can complement your investment strategy, check out our detailed guide on VOO Dividends. […]