Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

Is UPS a Smart Dividend Play for 2025? An In-Depth Look at the Risks and Rewards

United Parcel Service (UPS), the logistics giant with operations spanning over 220 countries, is grappling with significant challenges and opportunities as we approach 2025. Known for its substantial dividend payouts, UPS has long been a favorite among income investors. However, its stock performance has been volatile, leading many to question whether it remains a smart dividend play or if the risks outweigh the rewards.

In this article, we’ll delve into UPS’s current financial landscape, focusing on its dividend payout ratio, earnings projections, and overall market outlook. Is UPS still a good investment for those seeking dividend income, or should investors be wary of its recent downturns? Let’s break it down.

The Current State of UPS: Volatility and Declining Performance

UPS’s stock has been on a downward trajectory, with a decline of around 30% in the past year and a significant drop of 44.64% over the past five years. Once trading as high as $218 in 2022, the stock now hovers around $84, which raises a crucial question: Is this a buying opportunity or a sign of deeper issues?

Economic Uncertainty and Competition

The global logistics market is highly competitive, with major players like FedEx, Amazon, and newer technologies like drones challenging UPS’s dominance. Additionally, UPS’s large exposure to e-commerce and healthcare logistics has been both a strength and a liability. While e-commerce continues to drive growth, economic uncertainty and Amazon’s move to build its own delivery network have hurt UPS’s market share. As a result, analysts are divided on UPS’s future. Some predict a rebound, while others worry about declining volumes and the global trade slowdown.

UPS Dividend: A Generous Yield but Risky Payout Ratio

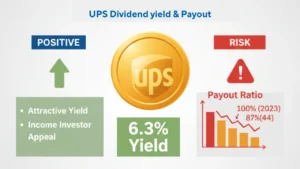

One of the biggest draws of UPS for income investors has been its attractive dividend yield. As of now, the company offers a robust 6.3% dividend yield, a substantial return compared to many other dividend stocks. However, this high yield comes with a high payout ratio that raises questions about sustainability.

In 2023, UPS’s free cash payout ratio surged to over 100%, indicating that the company was paying more in dividends than it was generating in free cash flow. This is unsustainable in the long run, as it leaves little room for reinvestment into the business, debt repayment, or share buybacks. To address this, UPS lowered its payout ratio in 2024 to around 87%, but even this is a large chunk of its cash flow.

Free Cash Flow: A Warning Sign for Investors

The company’s free cash flow has been another area of concern. From 2021 to 2022, UPS saw record-breaking free cash flow figures, but this has drastically declined in the past two years. In 2024, free cash flow is expected to be significantly lower, which means there may not be enough to cover dividends without straining the company’s financials.

When a company’s free cash flow fails to cover its dividend payouts, it typically has to dip into its balance sheet, taking on more debt or drawing from cash reserves. While UPS still maintains a strong balance sheet and healthy liquidity, there are growing concerns about the long-term sustainability of its dividend program.

Volatility and Guidance: What Does the Future Hold for UPS?

Another major red flag for investors is UPS’s lack of forward-looking guidance. The company recently withdrew its 2025 earnings and revenue forecasts due to macroeconomic uncertainty. This creates an environment of unpredictability, which investors generally try to avoid when looking for stable, reliable dividend stocks.

Furthermore, UPS has seen significant declines in average daily volumes, which dropped 7.3% year-over-year in the second quarter of 2024. This decrease in volume is troubling, as logistics companies typically rely on high volumes to drive profitability. While revenue per package has increased slightly, it hasn’t been enough to offset the volume loss, which signals that UPS could be in for a bumpy road ahead.

The Dividend Story: Is It Sustainable?

One of the primary reasons investors flock to UPS is its consistent dividend payments. But is this 6.3% yield sustainable, or is the company’s high payout ratio a warning sign?

Given the current financials, there is a real risk that UPS may need to reduce its dividend in the future if free cash flow doesn’t improve. While the company is undergoing a cost-reduction strategy and reconfiguring its network, it’s unclear whether these changes will be sufficient to stabilize its cash flow and continue funding the dividend at its current rate.

The Upside: Analyst Projections and Valuation

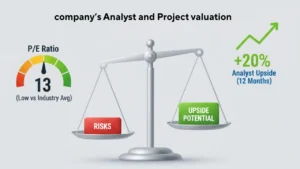

Despite these concerns, some analysts remain bullish on UPS. The company’s valuation is attractive, with a low PE ratio of just 13—much lower than the industry average. This suggests that the market may have priced in some of the risks associated with the stock, potentially making it undervalued.

Furthermore, analysts predict a 20% upside over the next 12 months, based on expectations of revenue recovery and improved earnings starting in 2026. However, these predictions hinge on UPS’s ability to navigate its ongoing challenges, including Amazon’s competition and economic headwinds.

Conclusion: Is UPS a Smart Dividend Play for 2025?

UPS is undeniably facing a complex set of challenges, including declining volumes, competition from Amazon, and uncertainty in global trade. While its 6.3% dividend yield is appealing, the high payout ratio and declining free cash flow raise significant red flags about the sustainability of its dividend payments. Additionally, the company’s lack of forward guidance and recent earnings volatility further complicate its investment thesis.

For dividend investors, UPS’s yield may still be attractive, but it’s essential to carefully consider the risks. Those willing to take on higher risk for potentially higher reward may see this as a buying opportunity, especially if the stock remains undervalued. However, conservative investors might want to wait until UPS can stabilize its operations and provide more reliable guidance.

Ultimately, UPS remains a risky dividend play, but it also holds potential for those who believe in its long-term prospects and are prepared to weather the volatility. Keep an eye on upcoming earnings reports and any signs of improvement in the company’s financials before making a decision.

![Is SCHD Dead Weight — Or the Ultimate Dividend Machine? [2025 Guide]](https://portfoliopayday.com/wp-content/uploads/2025/08/SCHD-Thumbnail-150x150.png)