Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

The Ultimate Guide to ULTY: A Game-Changer in High-Yield Income ETFs

If you’re a dividend investor, you’ve probably heard about ULTY, one of the most popular yet divisive ETFs out there. What makes ULTY stand out is its stunning 80% dividend yield, but there’s more to it than just high payouts. The ETF’s intriguing structure and strategy have made it a hot topic among income-focused investors.

In this article, we’ll break down everything you need to know about ULTY stock and its dividend history, helping you decide whether it’s the right addition to your portfolio.

What is ULTY?

ULTY is part of the YieldMax family of ETFs, known for targeting high-income distribution strategies. What sets ULTY apart from other YieldMax ETFs is its remarkable weekly dividend payout structure. Traditionally, ETFs pay monthly or quarterly, but ULTY pays out weekly dividends, which has been a game-changer for many income investors. But, like all investments, there’s more than meets the eye.

The fund focuses on covered call options, where it generates income by selling options on highly volatile stocks. This strategy helps ULTY produce high yields, which are then passed down to its investors in the form of dividends. However, ULTY doesn’t own the underlying stocks. Instead, it takes synthetic positions to mimic stock price movements, providing significant exposure to the underlying assets without actually owning them.

The Big Shift: Weekly Payouts of ULTY stock

Before March 2025, ULTY was notorious for NAV erosion. Investors would see their shares lose value as the ETF paid out its dividends, and the price wouldn’t bounce back. Since ULTY switched to a weekly payout model and adjusted its strategy, things have changed dramatically.

The most noticeable difference is in ULTY’s performance since the strategy shift. Previously, it was in a continuous downtrend, but now, with weekly distributions and improved strategies, the ETF has been much more stable. This has piqued the interest of many investors, and ULTY has seen an influx of new capital.

The Risks and Rewards of ULTY Stock

It’s important to remember that ULTY is not a traditional growth stock or ETF. It’s designed to provide high income, but its upside potential is capped due to the covered call options strategy. This means if the stock price of the underlying assets soars, ULTY’s returns won’t mirror those gains. The trade-off is that investors receive attractive dividends in exchange for limiting growth potential.

However, the high yield and the weekly payout structure make ULTY especially appealing to those seeking regular income. And while it comes with increased risk—especially due to the volatility of the stocks it holds—many investors find the reward worth it. For instance, if you invested $10,000 in ULTY, you could expect to receive around $150 per week in dividends.

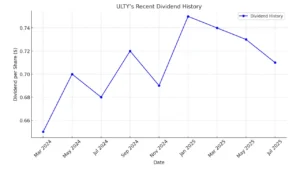

ULTY’s Recent Dividend History

Now, let’s discuss ULTY’s dividend history, a key aspect that attracts many investors. Since it switched to weekly dividends, ULTY has been paying approximately $0.09 to $0.10 per share every week, which translates to a 79% to 80% annual dividend yield. This is a stunning yield by any standard, making ULTY an attractive option for those looking to generate income through their investments.

One concern some investors have raised is the Return of Capital (ROC) in ULTY’s dividends. ROC is a tax classification, not necessarily a negative sign, but it’s something to watch carefully. A return of capital can reduce the cost basis of your investment, meaning you’ll owe taxes on the distributions when you eventually sell your shares.

As an investor, it’s crucial to monitor ULTY’s NAV (Net Asset Value). If the NAV keeps dropping, it might indicate that the fund is dipping into its capital to continue paying those high dividends. However, since the switch to weekly payments, the stability of the NAV has improved somewhat, which is a good sign for income investors.

Performance: Is ULTY Truly the Ultimate Income ETF?

While ULTY’s performance has been impressive since the strategy change, it’s important to note that it doesn’t always outperform the broader market. Over the past year, ULTY has delivered a 14.75% total return, slightly underperforming the S&P 500. However, its year-to-date performance, including dividends, is up 10.4%, which is a solid return, especially considering the ETF’s high dividend yield.

In comparison to other YieldMax funds like MSTY, ULTY’s total return is somewhat underwhelming. MSTY is up over 33% year-to-date, which shows that ULTY still has some catching up to do in terms of overall performance. Despite this, ULTY’s weekly payouts and high yield make it an appealing choice for income-focused investors.

Should You Invest in ULTY?

In conclusion, ULTY is a high-risk, high-reward investment. It offers some of the highest dividend payouts available in the market, but it’s not without its risks. If you’re looking for an ETF that delivers consistent weekly income and you’re comfortable with the potential risks of NAV erosion and limited growth, ULTY could be a good addition to your portfolio.

For those new to investing, income-focused ETFs like ULTY can be a great way to generate passive income. However, it’s crucial to understand the risks, particularly with options-based strategies that limit growth potential.

Before investing in ULTY, it’s essential to consider the overall market conditions, the potential for NAV erosion, and how ULTY’s weekly dividend history fits within your financial goals. As always, be sure to consult with a financial advisor to ensure it aligns with your investment strategy.

![Is SCHD Dead Weight — Or the Ultimate Dividend Machine? [2025 Guide]](https://portfoliopayday.com/wp-content/uploads/2025/08/SCHD-Thumbnail-150x150.png)