Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

TXN Dividend: What’s Going On with Texas Instruments’ Stock and Dividend?

Texas Instruments (TXN) has been a mainstay in the semiconductor industry, renowned for its history of steady performance and reliable dividends. In 2025, however, the company finds itself navigating some rough waters, with its stock down 13.6% over the past year and a 4.34% dip year-to-date. While Texas Instruments has historically outperformed the market with a solid 285% return over the past decade, the recent market volatility and concerns surrounding its financial health have left many wondering about the stability of TXN’s dividend.

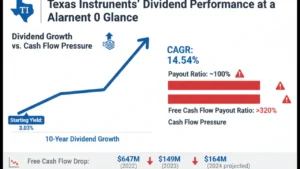

A Glance at Texas Dividend Stock Performance

Historically, Texas Instruments has been a dividend growth darling, with a 10-year compound annual growth rate (CAGR) of 14.54%, and a healthy starting dividend yield of 3.03%. For dividend investors, such stats are hard to ignore. But in the face of the company’s recent financial struggles, questions about the sustainability of TXN’s dividend have started to arise.

The payout ratio is sitting dangerously close to 100%, and even more concerning is the free cash flow (FCF) payout ratio, which exceeds a staggering 320%. This raises a red flag for any dividend investor: how sustainable is a dividend when the company’s free cash flow is down significantly? The year-over-year drop in free cash flow — from $647 million in 2022 to just $149 million in 2023, with a slight recovery to $164 million projected for 2024 — only adds to the uncertainty.

Breaking Down Texas Instruments’ Free Cash Flow Woes

Free cash flow is the lifeblood of a company, especially for those that pay out dividends. As the CEO, Rich Templeton, frequently mentions, free cash flow per share is crucial for long-term shareholder value. Texas Instruments’ commitment to dividends and share buybacks hinges on this metric. However, the company’s recent struggles with its cash flow have put that commitment under pressure.

In their investor presentations, management acknowledges that the company is in the midst of a substantial capital expenditure cycle to build new manufacturing capacity. While these investments are expected to pay off in the long term, they have contributed to a temporary reduction in free cash flow. Texas Instruments is nearly 70% through a six-year elevated capex cycle, which means that the effects on free cash flow are expected to be short-lived. Free cash flow is projected to rebound by 2026 as growth returns and capex moderates.

The Dividend Increase: A Silver Lining?

Despite these challenges, Texas Instruments recently announced a 4.4% dividend increase. While this is still positive, it’s below the company’s historical averages — particularly the 8% five-year dividend CAGR and the exceptional 14.5% 10-year dividend CAGR. The dividend hike may not be as substantial as investors have come to expect. Still, it’s an indication that the company remains committed to rewarding its shareholders, even during periods of financial strain.

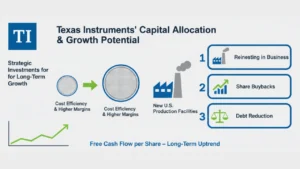

Texas Instruments’ Capital Allocation and Growth Potential

Texas Instruments’ capital allocation strategy is heavily focused on long-term growth. The company has made strategic investments in building low-cost, reliable manufacturing capacity, particularly in the U.S. This is expected to drive long-term growth in free cash flow per share. Texas Instruments is betting on an increase in wafer sizes — moving from 200mm to 300mm — which could lead to lower costs and higher margins.

The company’s management team has also been working diligently to balance its short-term obligations with long-term strategic investments. While their payout ratio is concerning, their commitment to capital management and free cash flow growth is clear. They plan to focus on reinvesting in the business, buying back shares, and reducing debt, all of which should improve the company’s financial position in the coming years.

TXN’s Valuation: A Question of Risk and Reward

Texas Instruments’ stock valuation is currently under scrutiny. After a 13.6% drop over the last year, many are questioning whether now is the right time to buy. The company’s valuation hinges largely on its free cash flow projections for the next few years. Management has been cautious with its guidance, predicting free cash flow per share to recover between 2025 and 2026. At the low end, free cash flow per share could reach $8-$9, which would put the company ahead of its previous peaks.

Based on discounted cash flow (DCF) models, Texas Instruments’ fair value is estimated at around $220 per share, about 18% higher than its current price. While this suggests some upside potential, the stock remains somewhat volatile, with its future price tied to the success of its capital expenditures and the cyclical nature of the semiconductor industry.

The Dividend Discount Model: Will the Dividends Continue to Grow?

Looking at Texas Instruments through the lens of the dividend discount model (DDM), the stock shows some promise. The dividend has grown at a high rate in the past, and while future growth might be slower, the dividend is still projected to increase in the coming years. Assuming a 5.5% dividend growth rate, the DDM estimates a price of about $191.31 per share, offering a 7% upside from its current price.

Conclusion: Is the TXN Dividend Safe?

While the recent drop in Texas Instruments’ stock price and concerns about its free cash flow are legitimate, the company’s long-term growth prospects remain strong. The current valuation, along with the potential for free cash flow recovery by 2026, suggests that Texas Instruments may be poised for a rebound. The dividend, while growing more slowly than in the past, is still secure and offers long-term income potential for dividend investors.

If you’re looking to buy Texas Instruments stock for its dividend, be mindful of the risks. While the dividend payout is currently under pressure, the company’s commitment to long-term growth and capital management could position it for success in the future. For those with a longer investment horizon, Texas Instruments could be an attractive stock to consider, especially if the price drops further.