Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

SMCY Dividend History: A Deep Dive Into YieldMax’s Latest Investment Opportunity

In the world of dividend investing, many seek stable, high-yield opportunities. One of the latest buzz-worthy funds is SMCY, a product from YieldMax that has been catching the attention of investors looking for consistent payouts. But how does this ETF really perform in terms of dividend returns, and is it worth adding to your portfolio? Let’s take a closer look at SMCY’s dividend history and understand its growth potential.

What Is SMCY?

SMCY is part of the YieldMax suite of ETFs, designed for investors seeking income through dividends. The fund primarily holds shares of Super Micro Computer, Inc. (SMCI) and employs an options strategy to generate revenue, primarily through the sale of calls. This strategy aims to provide a monthly income through dividends while also offering some upside potential, albeit capped due to the nature of covered calls.

The SMCY ETF is ideal for those bullish on Super Micro Computer but looking for consistent income from their investments. By utilizing options trading strategies like covered calls, SMCY aims to provide returns that exceed the typical dividend payouts you’d expect from standard ETFs.

SMCY Dividend History: A Rollercoaster Ride

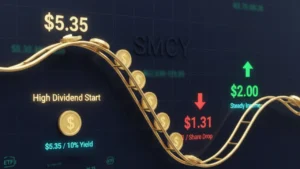

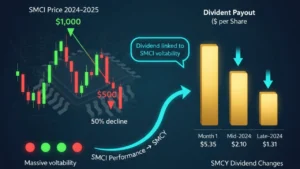

SMCY’s dividend payments have certainly been an interesting journey. The fund initially launched with a high dividend yield, paying out $5.35 per share in its first month of operation. This was a substantial payout, reflecting its ambitious strategy. However, as is often the case with such funds, the payout structure has adjusted as the share price fluctuates.

For example, early on, SMCY was paying out $5.35 per share at a yield of over 10%, which was impressive given its price point of about $50. But as the price of SMCI dropped, so did the fund’s dividends. By the time the share price fell to the mid-$20 range, the dividends started to reflect this lower valuation, coming down to $1.31 per share. Although the yield has fluctuated, the fund still manages to pay between $1.30 $2.00 per share monthly.

Despite these fluctuations, SMCY continues to offer one of the more attractive yields for a fund of its type. For long-term investors looking to accumulate shares while earning a reliable income, it’s important to understand the relationship between share price, the underlying stock’s performance, and the dividend payouts.

The Impact of SMCI’s Performance on SMCY Dividends

The performance of Super Micro Computer (SMCI) directly impacts the dividend payouts of SMCY. SMCI, which builds high-performance servers for AI and data center infrastructures, has seen massive volatility in its stock price since SMCY’s inception. The fund’s dividends are based on the underlying stock’s performance, and as SMCI fluctuates, so too do SMCY’s payouts.

SMCI’s price movements are a key factor in this fund’s volatility. In late 2024, SMCI experienced a significant drop, nearly halving in value. This sharp decline led to a corresponding decrease in the dividend payout of SMCY. The fund has also been underperforming compared to its underlying stock, especially when it comes to large upswings in SMCI’s price. Because SMCY’s upside is capped due to its option strategy, investors missed out on some of the larger gains in SMCI’s stock price.

However, despite these hurdles, SMCY’s option-selling strategy continues to provide regular payouts, making it an appealing option for those looking for monthly income, even in uncertain times.

What Can We Expect from Future Dividends?

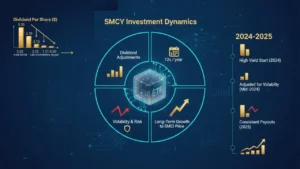

As of September 2025, SMCY announced a distribution of $1.31 per share, reflecting a yield of around 7.88% for the month. The fund’s consistent dividend payments, despite volatility in the underlying stock price, make it a reliable choice for investors seeking monthly income.

Looking ahead, the fund’s dividend history suggests a moderate yield that might not be as high as its initial payout, but still competitive when compared to many other dividend-focused ETFs. With the yield hovering between 5% to 10% annually, SMCY continues to attract investors who are willing to tolerate some price volatility in exchange for consistent income.

Investing in SMCY: What You Need to Know

While SMCY’s dividends have been attractive, it’s essential to understand the risks involved with investing in such a fund. The combination of high dividend payouts and the use of options strategies (such as covered calls) makes it a more complex investment vehicle than a standard dividend ETF.

Here are a few key takeaways for those considering SMCY:

- Dividend Adjustments: The dividend payout fluctuates based on the price of SMCI and the effectiveness of the fund’s options strategy. As SMCI’s price increases, the fund may pay higher dividends; however, large increases in stock price could lead to underperformance in the fund due to the covered call strategy.

- Monthly Payouts: Investors can expect monthly dividends, but these payouts can vary depending on the fund’s performance and the underlying stock’s volatility. While dividends have dropped from their initial highs, they remain relatively consistent and above average for high-yield funds.

- Long-Term Performance: As with any dividend-focused ETF, SMCY’s long-term performance is tied to both the stock price of SMCI and the broader market conditions. While the fund has been affected by drops in SMCI’s price, it continues to provide reliable payouts for those invested in it long-term.

- Volatility: The fund’s use of options trading means that there are limits on the upside of the stock, which could impact its performance during large bull runs. However, for investors looking to generate consistent income, the trade-off between volatility and regular dividend payouts might be worth it.

Is SMCY a Good Investment for You?

For those interested in SMCY stock dividends, it’s crucial to balance the risk of volatility with the reward of monthly payouts. If you’re seeking a consistent income and are okay with the potential for price fluctuations, SMCY offers an appealing solution.

However, it’s essential to stay informed about SMCI’s stock price movements and understand how option strategies affect the fund’s payouts. For investors looking to diversify their portfolio with a high-yield dividend fund that utilizes a unique options strategy, SMCY could be a smart addition. Just remember, like any investment, it comes with its risks, and it’s always wise to do your own research before making any decisions.

![Is SCHD Dead Weight — Or the Ultimate Dividend Machine? [2025 Guide]](https://portfoliopayday.com/wp-content/uploads/2025/08/SCHD-Thumbnail-150x150.png)