Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

Introduction: Is SCHD Still Worth Holding in 2025?

If you’re like me and have been investing for quite a few years now, you’ve probably heard about all about SCHD, the Schwab U.S. Dividend Equity ETF. Some people swear by it for steady income, while others are now asking, “Is SCHD dead weight?” “Am I losing out on other opportunities by holding this ETF?”

In this post, I’m going to dig into that exact question, not with hype, but with actual information, dividend data, tax efficiency, and a real-world case study.

Whether you’re planning for early retirement, seeking passive income, or simply looking to balance growth and stability in your portfolio, let’s break it all down.

Why SCHD Has Fallen Behind in 2025 (On the Surface)

Let’s start with the big question: Why has SCHD underperformed compared to the S&P 500 and high-growth ETFs like QQQ or SCHG in 2025?

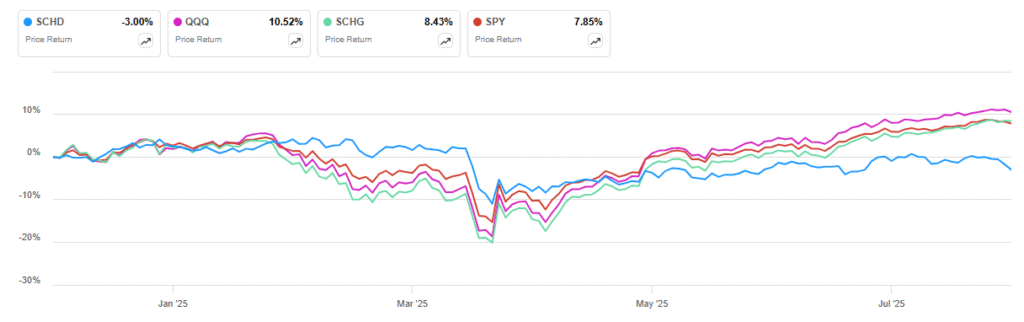

Looking at year-to-date performances as of July 2025, SCHD is down about -3%, according to Seeking Alpha. In contrast, the SPY is up almost 8% YTD and QQQ is over 10%.

So, naturally, some investors are asking: Is SCHD really worth it?

Price Return vs Total Return

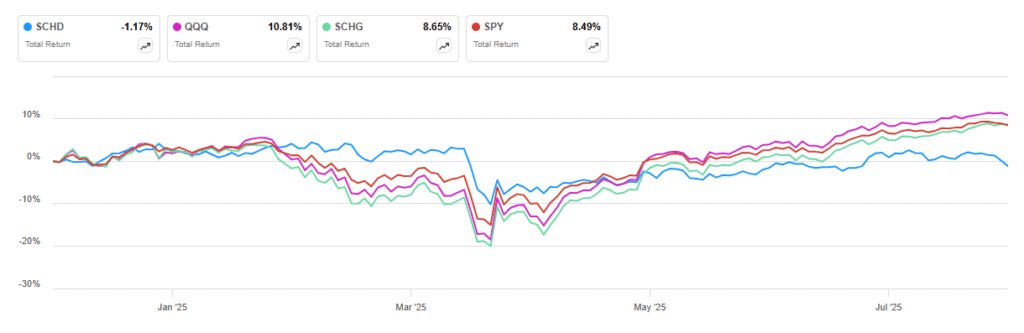

Looking at the example above, this is only looking at price return. So how does SCHD compare when we factor in dividend income for a total return?

This ETF is all about dividend income, not just capital gains, but is it enough to make it worthwhile? When you look at total return, which includes dividend reinvestments, the picture still is a little bleak.

- SCHD 2025 Total Return (YTD): -1.17%%

- SPY 2025 Total Return (YTD): +8.49%

- SCHG 2025 Total Return (YTD): +8.65

- QQQ 2025 Total Return (YTD): +10.81%

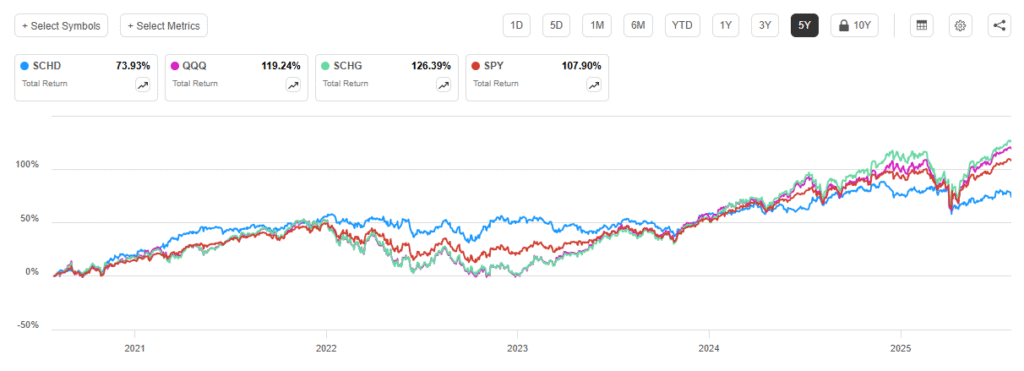

Still a lag? Yes! It’s very disheartening, but let’s see how it looks if we pull back the chart to 5 years, and here’s where it gets interesting:

-

SCHD: +74%

-

SPY: +108%

While it’s not on par with the growth potential of the other ETFs, keep in mind, SCHD is NOT a growth stock; It’s a DIVIDEND growth stock. And while it doesn’t match or come close with the other growth stocks annual growth potential, it still averages almost 15% annual growth which is pretty damn good.

What SCHD Is Actually Built to Do

SCHD isn’t a tech-growth rocket ship — and that’s exactly the point.

Here’s what makes SCHD special:

-

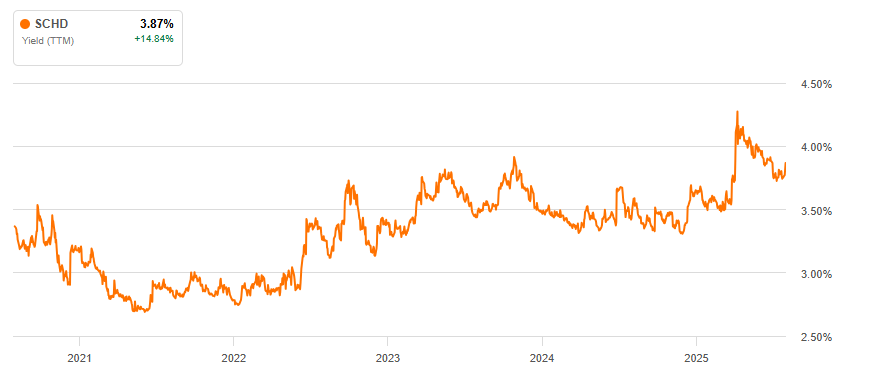

Dividend Yield (2025): 3.87%

-

Expense Ratio: 0.06% (among the lowest in the ETF space)

-

10-Year Average Annual Price Return: ~11.18%

-

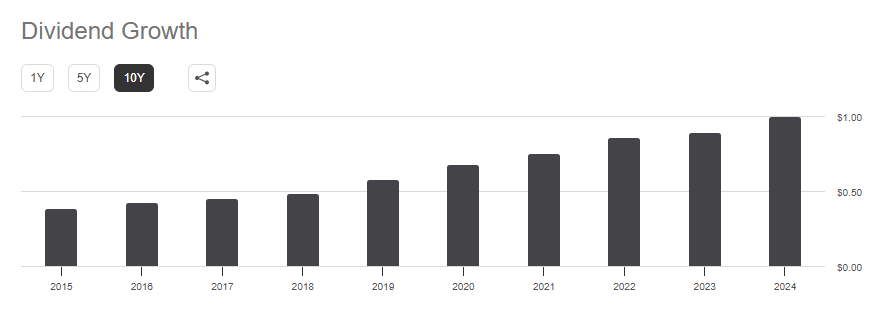

Dividend Growth (10 Years):

-

Holdings: Blue-chip dividend stocks like Abbvie, PepsiCo, Chevron, Cisco, Merck, Home Depot and more

It focuses heavily on consumer defensive sectors; think Energy, Consumer Staples, Health Care… the kind of companies that keep making money through good times and bad. That’s why SCHD didn’t crumble in 2022. It’s also why it isn’t soaring in the current AI-fueled tech boom.

Tax Efficiency of SCHD: A Quiet Superpower

SCHD’s tax efficiency is one of the least talked about but most important reasons it fits into a long-term wealth strategy.

Here’s why:

-

Qualified Dividends: Most of SCHD’s dividend payouts qualify for lower long-term capital gains tax rates (15%-20% vs. 37% for ordinary income).

-

Low Turnover: SCHD has a portfolio turnover rate around 40%, which reduces taxable events.

-

Tax-Loss Harvesting Opportunities: In years of underperformance, SCHD can offer tax harvesting potential while still keeping your dividend stream alive.

When held in a Roth IRA, SCHD’s dividends grow and compound completely tax-free. If held in a taxable brokerage, it’s still more tax-friendly than most high-turnover ETFs.

Real Case Study: SCHD Over 25 Years

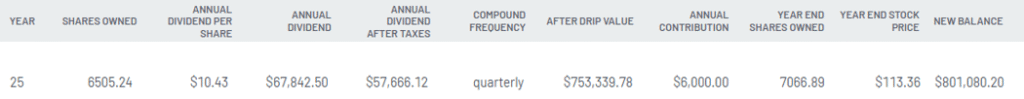

Let’s say you start investing $500/month into SCHD, reinvesting all dividends.

-

Starting Investment: $0

-

Annual Contribution: $6,000

-

Expected Dividend Annual Increase (Conservative): 10% annually

-

Dividend Reinvestment: Yes

Using a compound growth calculator:

-

25-Year Total Value: $801,080

-

Estimated Annual Dividend Income (Year 25): ~$67,842.50

That’s over $5600/month in passive income — without ever increasing your monthly contributions.

Growth vs Income: The Real Portfolio Question

If you’re under 40 and only buying dividend ETFs like SCHD, you might be leaving serious money on the table by not taking advantage of the growth of ETFs like QQQ, SCHG, or VUG

High-growth ETFs like:

-

QQQ (tech-focused, up 113% in 5 years)

-

SCHG (Schwab Growth ETF, up 126% in 5 years)

…have outpaced SCHD in bull markets.

So where does SCHD fit?

It’s not a replacement for growth ETFs, but it’s a perfect complement in a 3-fund portfolio:

-

Growth (SCHG, QQQ, VUG)

-

Income (SCHD, DGRO, VYM)

-

Broad Market/International (VTI, VXUS)

Who Should Actually Own SCHD?

Based on my experience, here’s who I think SCHD is best for:

✅ Near-Retirees: You want dependable income with reduced volatility.

✅ Volatility-Averse Investors: Can’t sleep when tech stocks dive? SCHD offers peace of mind.

✅ Long-Term Passive Builders: You want income that builds itself while you sleep.

✅ Roth IRA Holders: Maximize the tax efficiency and never pay a dime in taxes on dividends.

If you’re 20, 30, even 40 and hyper-focused on dividends without understanding the trade-off of growth, you might be over-indexing too early. Consider balance.

The Bottom Line: Is SCHD “Dead Weight”? Not Even Close.

SCHD isn’t dead weight because it’s doing exactly what it was built to do: deliver reliable, growing income through all market cycles.

Sure, in a tech-dominated bull market, it’s not the sexiest pick. But when things go south, it’s the calm in the storm.

If your goals include:

-

Financial independence

-

Passive income

-

Risk-adjusted stability

-

Long-term wealth building

…SCHD still deserves a spot in your portfolio. Just don’t make it your only ETF.

Pair it with a smart mix of growth and broad-market funds, and you’ve got a strategy that’s built to weather any market.

![Is SCHD Dead Weight — Or the Ultimate Dividend Machine? [2025 Guide]](https://portfoliopayday.com/wp-content/uploads/2025/08/SCHD-Thumbnail.png)

[…] SCHD (Schwab U.S. Dividend Equity ETF) […]

[…] Additionally, SCHD focuses on investing in companies with strong fundamentals and a consistent history of paying and growing dividends. This makes SCHD a great option for investors looking for a stable, long-term growth strategy that doesn’t rely on high-risk or speculative investments. If you want to know about the worth of SCHD in 2025 then you can read our detailed article of ” SCHD dead or ultimate dividend machine”. […]