Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

DGRO vs SCHD: Which Dividend ETF is Best for Your Portfolio?

When it comes to dividend-focused exchange-traded funds (ETFs), two names stand out as crowd favorites: DGRO (iShares Core Dividend Growth ETF) and SCHD (Schwab U.S. Dividend Equity ETF). Both funds have built strong reputations, but which one should you choose to maximize your long-term wealth and passive income?

In this article, we’ll dive into the key differences & comparison , strengths, and weaknesses of DGRO vs SCHD, and how they stack up in terms of dividend yield, growth potential, historical returns, and sector allocations. So, whether you’re a seasoned investor or just starting, we’ve got you covered to help you make the best decision for your portfolio.

DGRO vs SCHD: Understanding the Basics

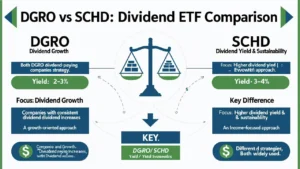

At first glance, DGRO and SCHD may seem like similar investments, both targeting dividend-paying stocks. But as we dig deeper, we uncover some important differences that could sway your decision.

DGRO (Dividend Growth)

DGRO is focused on dividend growth. This ETF targets companies that have a consistent record of increasing their dividends year over year. While the dividend yields are typically lower than SCHD’s, DGRO aims to offer long-term capital appreciation through dividend growth. Companies within DGRO tend to have a lower yield (around 2% to 3%) but compensate with faster-growing dividends, making it ideal for growth-oriented investors seeking compounded returns over time.

SCHD (Dividend Yield and Sustainability)

SCHD, on the other hand, focuses on dividend sustainability and higher yields. This ETF screens for companies that not only have strong, reliable dividends but also a proven track record of consistently paying out. With a higher yield (typically 3% to 4%) and more established dividend-paying companies, SCHD provides steady income, making it a top choice for income-focused investors or those nearing retirement.

Comparing the Dividend Yields

One of the most critical factors for dividend investors is the dividend yield, which can directly affect how much income you generate from your investments.

- SCHD currently boasts a dividend yield of 3.72% (as of 2025), making it an attractive option for those who rely on dividends for passive income.

- DGRO, with a yield of approximately 2.18%, offers a lower payout, but the growth potential is higher. If you’re in it for long-term wealth-building and can reinvest your dividends, DGRO might be the better pick.

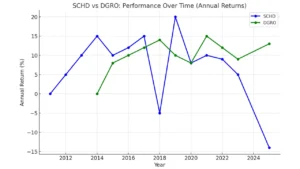

Performance Over Time: Past Returns & Growth

While dividends are a major attraction for both funds, it’s important to consider long-term returns and how each fund has performed historically.

SCHD Performance

- SCHD has been a solid performer since its inception in 2011. Over the past 5 years, it has consistently outpaced the market with a compound annual growth rate (CAGR) of 11.26%.

- If we look at 2025, SCHD has had a rough start, falling from $28 to $24, but its historical returns (213.78%) continue to showcase why it’s a favorite among dividend investors.

DGRO Performance

- DGRO has slightly outperformed SCHD in terms of total returns since its launch in 2014, with an 11.75% CAGR. Over the last 10 years, a $10,000 investment in DGRO would have grown into $30,066—a bit ahead of SCHD.

- DGRO’s performance shines when reinvested dividends are factored in, although it typically trails SCHD in terms of yield.

Sector Exposure: How Do They Stack Up?

Sector allocation is another important factor when choosing between these two ETFs. SCHD and DGRO have different approaches to their sector exposure, and this can affect both dividend income and growth potential.

- SCHD has a heavy focus on financials, consumer defensive stocks, and healthcare, with an emphasis on sectors that perform well during both bull and bear markets.

- DGRO, on the other hand, has a more tech-heavy portfolio, including major tech companies like Apple, Microsoft, and Johnson & Johnson. The advantage of this is that you can take advantage of tech’s strong growth potential, but it comes with a lower yield.

For investors who already own tech-heavy funds or stocks like the S&P 500, SCHD may offer better diversification and lower risk by providing exposure to value stocks and defensive sectors.

Which ETF is Right for You?

The decision between DGRO vs SCHD ultimately comes down to your investment goals and risk tolerance.

- Choose SCHD if you want higher dividends, a strong historical yield, and a focus on established dividend-payers. SCHD is ideal for income-focused investors and those looking to maintain a steady cash flow.

- Choose DGRO if you prioritize long-term growth, are willing to accept a lower yield, and want exposure to dividend growth stocks in the tech sector. DGRO is a great fit for growth investors looking to build wealth over time while still benefiting from dividends.

DGRO vs SCHD—The Verdict

Both DGRO and SCHD offer solid returns, but they cater to different investor needs. If you’re seeking higher dividends with stability in your portfolio, SCHD might be the right choice for you. If you’re focused on growth potential, especially in the tech sector, and are willing to accept a lower initial yield, then DGRO could be a better fit.

Ultimately, you don’t have to choose just one. Combining both funds can offer you the best of both worlds: SCHD’s strong dividends and DGRO’s growth potential. Either way, you’re positioning yourself to capture the power of dividends and capital appreciation, making both of these ETFs valuable additions to your investment strategy.