Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

ARR Dividend: A Comprehensive Look at ARM Residential REIT’s Performance

In the world of Real Estate Investment Trusts (REITs), few names generate as much attention as ARM Residential REIT (ARR), particularly among investors focused on high-yield dividends. If you’re considering investing in REITs for passive income, understanding the nuances of ARR’s dividend performance is key. This article delves into the financials of ARR, focusing on its dividend history, stock performance, and the strategic moves made by the company. Whether you’re new to REITs or a seasoned investor, this breakdown will help clarify why ARR stock dividend is a topic of debate among the financial community.

What is ARM Residential REIT?

ARM Residential REIT is a company that operates within the mortgage real estate investment trust sector, primarily investing in agency-backed securities. These securities offer predictable returns, making them a popular choice among income-focused investors. However, just like any investment, the performance of ARM Residential REIT can be influenced by multiple factors, such as changes in interest rates, housing market fluctuations, and management decisions.

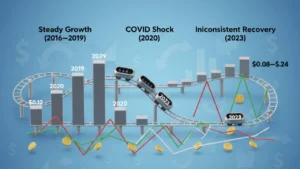

The ARR Dividend History: A Roller Coaster Ride

For investors who are drawn to high-yield dividends, ARM Residential REIT has been a source of both interest and frustration. To understand why, let’s take a closer look at its dividend history. In 2016, ARR’s monthly dividend was a respectable $0.22 per share. Fast forward to 2023, and the dividend had dipped to a meager $0.08. The reduction in dividends has raised questions about the company’s overall performance and its ability to generate consistent returns.

In 2020, ARM Residential REIT was hit particularly hard, dropping from $0.18 to $0.12 per share. This dip was a response to the economic shockwaves caused by the COVID-19 pandemic, which led to disruptions in mortgage-backed securities (MBS) markets. Although the company saw a slight recovery in 2023 with a dividend of $0.24 per share, it has struggled to match the performance levels of earlier years. In fact, ARM Residential REIT has not seen a dividend return anywhere close to the $0.29 per share level it paid in 2019. For many, this inconsistency in dividend growth is a significant red flag.

Revenue Trends: The Dark Side of High-Yield REITs

When you invest in REITs, you’re essentially betting on the company’s ability to generate revenue from its properties or securities. With ARM Residential REIT, however, investors are seeing a concerning trend: declining revenue.

In 2019, ARR’s revenue hit $2.8 billion, a peak that hasn’t been approached since. Since then, it’s been a downward slope. The company’s revenue for 2022 was just $1.6 billion, significantly below the 2019 numbers. Although there was a slight uptick in 2023 to $2 billion, it’s still nowhere near its peak. Additionally, ARR’s quarterly revenue has seen dramatic fluctuations, with a sharp 65% decline in June 2023. Such a decline calls into question the long-term viability of ARR as a consistent performer in the dividend stock market.

Reverse Stock Splits: A Double-Edged Sword

One of the more controversial aspects of ARM Residential REIT’s performance has been its reliance on reverse stock splits. A reverse stock split is a maneuver where a company consolidates its shares to artificially raise the stock price, often used when a stock price is dangerously low. ARM Residential REIT initiated a 1-for-5 reverse split, which temporarily boosted the stock price from $4.8 to $24 per share. However, this move does not impact the company’s actual value; it’s merely a cosmetic adjustment.

Unfortunately, the reverse split hasn’t resulted in any meaningful long-term improvements in ARR’s market position or dividend payouts. The dividend yield has remained volatile, and many investors see this move as a way to mask underlying issues rather than resolve them. Despite the reverse split, the company has continued to struggle in key areas of financial performance, especially when it comes to dividends.

The ARM Residential REIT Dividend Philosophy

ARM Residential REIT aims to provide consistent and stable dividends, but its track record suggests otherwise. The company’s monthly dividend strategy is designed to offer investors a steady income stream. The goal of a 24-cent monthly payout—equivalent to 72 cents per quarter—is ambitious, but the reality has been marked by inconsistency.

In the most recent quarter, ARM Residential REIT paid out dividends of $0.24 per share, consistent with its payout in previous periods. While this may seem like a decent return, it represents a yield that has become increasingly less attractive compared to other high-yield dividend stocks in the market. The company aims to pay an “attractive” dividend, but whether it can achieve this goal depends on improving its financial metrics and diversifying its portfolio to buffer against economic downturns.

Navigating the Challenges of ARM Residential REIT’s Future

Looking ahead, ARM Residential REIT faces multiple hurdles. While the company has a strong focus on managing its portfolio with a balance of mortgage-backed securities (MBS) and treasuries, it’s crucial for the company to regain investor confidence by delivering more predictable performance. Interest rate fluctuations and shifts in housing demand will continue to play a critical role in determining the company’s ability to maintain its dividend payouts.

Additionally, ARM Residential REIT will need to address its dividend volatility. Investors looking for consistency in high-yield dividends will need to evaluate whether ARM Residential REIT’s shaky track record aligns with their long-term income goals. As of now, the company’s ARR stock dividend remains far from stable, and its prospects for future growth hinge on improving revenue generation and stabilizing its dividend policy.

Conclusion: Should You Invest in ARM Residential REIT 2025 ?

Investing in ARR dividend stocks can be enticing for income-seeking investors, but as shown with ARM Residential REIT, the risks are equally high. While the ARR stock dividend may still offer a substantial yield, the company’s inconsistency in dividend growth, reverse stock splits, and revenue declines paint a less-than-optimistic picture.

As with any high-yield REIT investment, it’s important to conduct thorough due diligence. ARM Residential REIT’s strategy is highly dependent on the fluctuating real estate market, which can be volatile in unpredictable economic climates. Investors should assess whether the potential rewards outweigh the risks, especially given the company’s poor dividend history and ongoing struggles in key revenue areas.