Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

Unveiling the NVDA Options Chain: A Deep Dive into Trading Strategies and Market Trends

When it comes to trading options, few stocks attract as much attention as Nvidia (NVDA). Known for its dominance in the tech sector, particularly in AI and semiconductor markets, NVDA has become a top choice for traders navigating the complexities of the stock market. Whether you’re an experienced options trader or a beginner, understanding the NVDA options chain is crucial for making informed decisions.

In this article, we’ll explore what the NVDA options chain is, break down its components, and delve into key strategies using the NVDA options chain Greeks. We’ll also discuss how recent market movements and the latest company developments impact NVDA’s options landscape.

What Is the NVDA Options Chain?

An options chain is a listing of all available options contracts for a given stock, organized by strike price and expiration date. For Nvidia, this chain contains valuable information for traders looking to speculate on the future price movement of the stock. The NVDA options chain shows both call options (bets that NVDA’s stock price will rise) and put options (bets that NVDA’s stock price will fall), along with their associated strike prices, expiration dates, and the volume of trades.

The NVDA options chain is a vital tool for traders because it reflects how the market perceives future volatility, price direction, and overall sentiment towards Nvidia. Options chain trading activity for NVDA often indicates upcoming trends that stockholders can use to their advantage.

The Role of the NVDA Option Chain Greeks

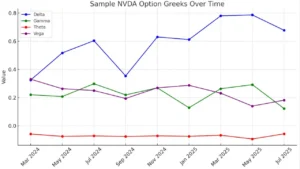

To fully understand the NVDA options chain, it’s essential to grasp the concept of the “Greeks”—a set of metrics that help traders assess risk and price sensitivity. These include:

- Delta: Measures the change in an option’s price relative to a $1 move in the underlying stock.

- Gamma: The rate of change in Delta, helping traders understand how much Delta will change as the stock moves.

- Theta: The time decay of an option, showing how much value an option loses as it approaches expiration.

- Vega: The sensitivity of an option’s price to changes in implied volatility.

When analyzing the NVDA option chain Greeks, traders often look for high Delta values in call options if they expect a rise in NVDA’s stock price. Alternatively, they may look for high Theta values if they expect volatility to decrease over time. By observing how these Greeks behave in Nvidia’s options chain, traders can form strategies that align with their predictions about the stock’s movement. For instance, if the market sentiment is bullish and Delta increases for certain calls, it suggests that traders expect a price jump, making those options more profitable.

Key Insights into Recent NVDA Options Activity

A closer look at recent options data reveals some interesting trends. As of the latest trading session, there has been notable activity in NVDA’s call options at higher strike prices. Specifically, the $110 and $100 strike calls have shown substantial trading volume, signaling a bullish outlook from options traders. This aligns with the broader market sentiment, which has favored tech stocks, particularly those like Nvidia, poised to benefit from the rise of artificial intelligence and machine learning.

Why NVDA’s Stock Option Chain Matters

Understanding the dynamics of the NVDA stock option chain is essential for navigating the stock’s price movements. Nvidia’s stock options are often actively traded because of the company’s cutting-edge position in the semiconductor and AI industries. Given the rapidly evolving technology sector, NVDA tends to have volatile price swings, which create opportunities and risks for options traders.

For example, Nvidia’s stock has recently experienced fluctuations due to various macroeconomic factors and news releases. This has led to a surge in interest around Nvidia options, especially those close to key strike prices. Traders often use the NVDA options chain to predict these fluctuations and position themselves for maximum profit.

Trading Strategies for NVDA Options

Given Nvidia’s historical performance and market outlook, traders use various strategies to capitalize on NVDA’s options chain. These strategies are typically based on the Greeks, technical analysis, and the broader market context. Here are a few options strategies to consider when trading Nvidia:

- Covered Calls: This strategy involves holding the underlying stock (NVDA) and selling call options against it. It’s useful for generating income if you believe NVDA’s stock will not significantly rise in the short term.

- Long Straddles: If you’re uncertain about NVDA’s direction but expect volatility, you can buy both calls and puts at the same strike price and expiration date. This allows you to profit from large price movements in either direction.

- Vertical Spreads: In this strategy, you buy a call or put at one strike price and sell another at a higher or lower strike. It’s a way to limit your risk while still benefiting from price movements.

These strategies can be fine-tuned using NVDA options chain greeks to minimize risk and maximize returns.

Final Thoughts

Nvidia’s options chain, NVDA, remains an invaluable tool for traders seeking to capitalize on the stock’s volatility. By analyzing the NVDA stock option chain and its associated Greeks, you can make more informed decisions, whether you’re taking a conservative approach or aiming for higher-risk opportunities. Keep an eye on the market’s sentiment toward Nvidia, and be prepared to adjust your strategies as the landscape evolves.

Remember, options trading involves significant risk, and it’s important to do your research and potentially seek advice from financial professionals before diving in.

[…] of Nvidia’s stock and explore more advanced trading strategies, you can check out our article NVDA Chain Options. This guide offers valuable insights into trading Nvidia options and can complement your knowledge […]