Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed financial advisor.

SPYI vs QQQI: Which Monthly Dividend ETF Is Right for Your Portfolio?

When I first started exploring income-generating ETFs, I was overwhelmed by the sheer number of options available. There were so many to choose from. The problem was, how can you be sure that the ones you add to your portfolio are going to be around for the long haul? After doing extensive research and review, I decided I had seen enough information to determine that QQQI ETF (NEOS Nasdaq 100 High Income ETF) and SPYI ETF (NEOS S&P 500 High Income ETF), were the ones for me, as they kept popping up in my research. These ETFs have become popular among dividend investors, and for good reason. They offer a combination of monthly dividend income, covered call strategies, and exposure to well-known indices like the Nasdaq 100 and S&P 500. Today, I’ll share why I believe these ETFs deserve a closer look if you’re aiming to earn passive income, build long-term wealth, and grow your retirement portfolio using ETFs.

Why Should You Consider Monthly Dividend ETFs Like QQQI and SPYI?

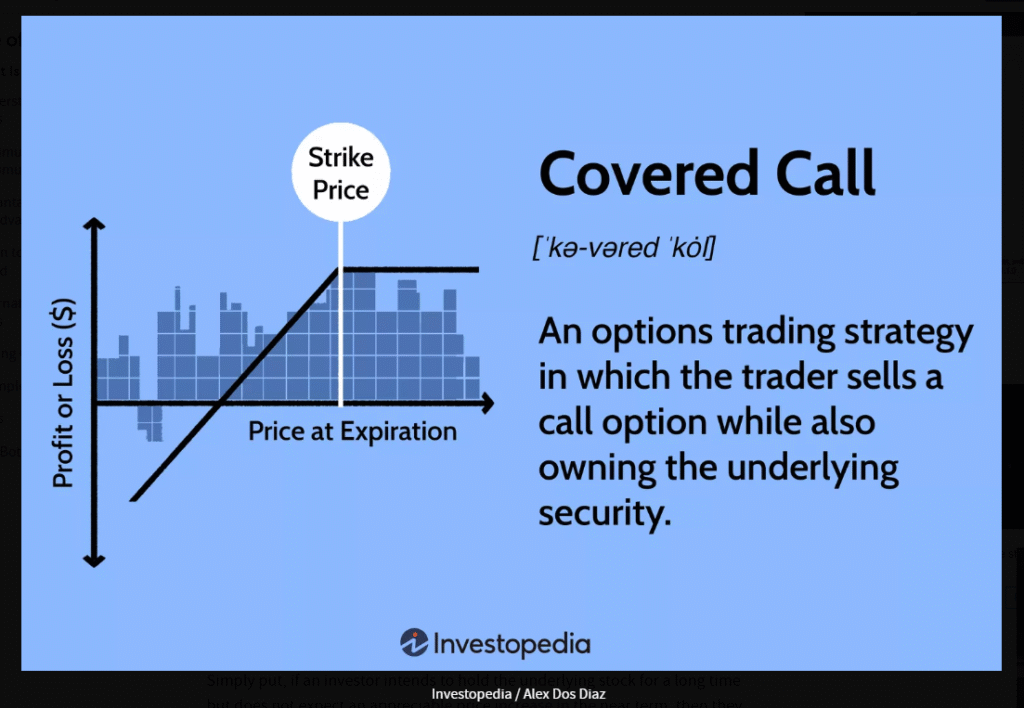

QQQI and SPYI aren’t just your typical ETFs. They’re covered call ETFs designed to generate consistent monthly dividend income while offering exposure to the Nasdaq-100 and S&P 500. If you’ve ever wondered how to combine dividend investing with long-term market exposure, this deep dive is for you.

Let me ask you a few questions:

-

What if your portfolio could pay you a steady income every single month?

-

Wouldn’t you sleep better knowing your money was working for you passively?

-

What if you could reinvest those dividends and multiply your returns over time?

That’s exactly what QQQI (NEOS Nasdaq 100 High Income ETF) and SPYI (NEOS S&P 500 High Income ETF) aim to do.

They combine high-yield dividends, monthly distributions, and tax-efficient income, all within the structure of a traditional ETF. And best of all? You don’t need to be a financial expert to benefit from them.

What Is QQQI?

QQQI is a high-income ETF that tracks the Nasdaq-100, which includes heavy hitters like Apple, Microsoft, and Nvidia. But QQQI adds an additional layer: it writes covered call options to generate extra income.

Benefits of QQQI:

-

Exposure to top-performing growth stocks in the tech sector

-

Generates monthly dividend income via options premiums

-

Uses tax-efficient options strategies under Section 1256

-

Average yield between 13-15% annually

-

Designed to outperform traditional dividend ETFs

If I invested $10,000 into QQQI and it paid an 14% yield annually, that’s about $1400 per year in dividends—or $116 per month in passive income. That could cover my phone bill, a gym membership, or even be reinvested to build more wealth. Ask yourself: wouldn’t it be amazing to see monthly ETF dividend income hit your account without lifting a finger? By now, you’re probably thinking to yourself, is QQQI a good investment?

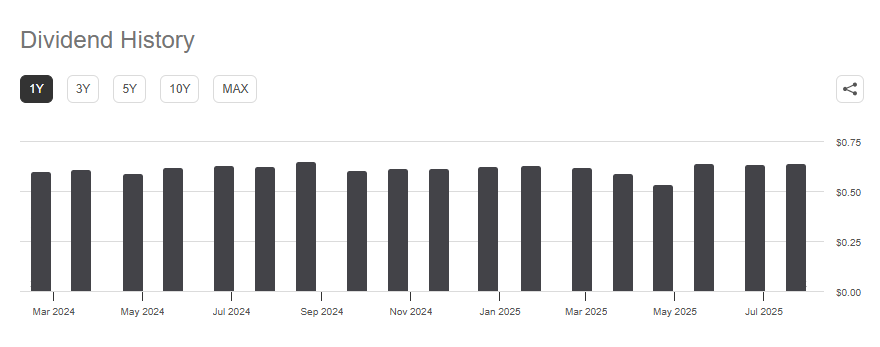

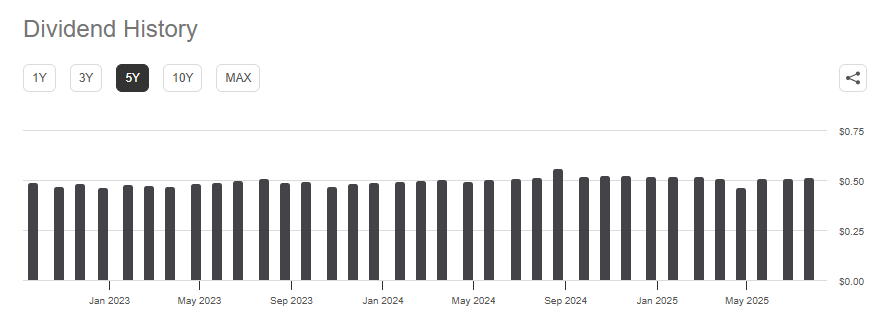

What Is SPYI?

SPYI is similar in structure but tracks the S&P 500, offering broad exposure to U.S. large-cap stocks like Johnson & Johnson, Amazon, and JPMorgan.

Benefits of SPYI:

-

Exposure to the most diversified index in the U.S. market; some of the top companies across all sectors

-

Covered call strategy adds consistent monthly income

-

Yield also around 11%–13%

-

Lower volatility compared to Nasdaq-focused ETFs

-

Great for passive, conservative investors wanting reliable income as the fund generates option premium income, creating a steady flow of cash.

Just to give you an idea of the income potential for this ETF, a$50,000 investment nets $500 per month, helping cover bills and groceries—all without touching the principal.

QQQI vs. SPYI: Key Differences

| Feature | QQQI | SPYI |

|---|---|---|

| Index Tracked | Nasdaq-100 | S&P 500 |

| Sector Exposure | Tech-heavy (Apple, Nvidia, Microsoft) | Diversified (Financials, Healthcare, Tech) |

| Dividend Yield | 13-15% (monthly) | 11–13% (monthly) |

| Growth Potential | Higher (but with volatility) | Moderate (more stability) |

| Tax Efficiency | Section 1256 contracts | Section 1256 contracts |

| Risk Profile | Higher volatility | Lower volatility |

Why Dividend Income Matters for Passive Investors

Dividend investing is a time-tested strategy used by everyone from beginner investors to multimillionaires. Think Warren Buffet and his wildly famous investment in Coca Cola. In 2024, he collected $776 million dollars in dividend income from his investment, and that’s just passive income.

So what makes the dividend income from QQQI and SPYI any different? Because these 2 ETFs pay monthly dividends:

-

Monthly payouts = better cash flow

-

Easier to budget in retirement

-

Enables faster compounding with DRIP (dividend reinvestment plans)

-

More frequent income than traditional quarterly dividend ETFs

Imagine a future where your monthly dividend income pays for your rent, car payment, or a nice dinner. That’s the power of dividend investing and exactly the reason why I invest in these 2 regularly!

How These ETFs Fit into a Long-Term Retirement Plan

I personally believe in a diversified retirement income stream. Instead of relying solely on Social Security or a pension, why not build an income-generating portfolio? So for me, here is how QQQI and SPYI fit in:

-

QQQI brings high-growth potential and high yield. Perfect for the accumulation phase of retirement investing.

-

SPYI is better for preserving capital while still generating income. Great for the distribution phase of retirement.

You can even blend them. A 50/50 split gives exposure to both the Nasdaq-100 and S&P 500 while averaging the risk and smoothing out income. I personally started investing in SPYI long before I invested in QQQI, only because I liked the more conservative trend that the overall S&P 500 follows. However, looking back, I would have followed more of an split approach, investing in both ETFs 50/50 so I could be earning more income from QQQI.

Which ETF Is Better Out Of These: SPYI QQQI?

This depends on your financial goals and risk tolerance.

Ask yourself:

-

Do I prefer growth and higher volatility for potentially higher returns? → Go with QQQI.

-

Do I want stable income and broader diversification? → Choose SPYI.

-

Want both? Then create a balanced allocation using both ETFs!

A Few Things to Think About

-

The Compounding effect of reinvesting these high yield dividend ETFs will supercharge your portfolio and your monthly income. This will earn you more dividends which then will buy more dividends on top of more dividends.

-

The flexibility of a high yield investment where you can either use dividends to supplement retirement income or reinvest for more growth.

-

If you start with $50,000 in high income ETFs and add $500 monthly, reinvesting the dividends, you could build a 7-figure portfolio over the next 25 years while earning substantial income.

How to Start Investing in These ETFs

-

Open a brokerage account (Fidelity, Vanguard, Schwab, Robinhood).

-

Look up QQQI ETF and SPYI ETF.

-

Consider setting up auto-investing and dividend reinvestment (DRIP).

-

Monitor your monthly income—watch your cash flow grow!

My Personal Portfolio Strategy

I personally hold both QQQI and SPYI.

-

QQQI gives me access to cutting-edge tech companies plus a current 14% yield.

-

SPYI gives me balance, broad diversification, and consistent cash flow. And as I am writing this, a 12% yield as well.

If you’re looking to diversify your dividend income while still participating in long-term growth, you really can’t go wrong with either, or both.

![Is SCHD Dead Weight — Or the Ultimate Dividend Machine? [2025 Guide]](https://portfoliopayday.com/wp-content/uploads/2025/08/SCHD-Thumbnail-150x150.png)