Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

The Power of QQQM Dividends: Why This ETF Is a Smart Long-Term Investment

When it comes to investing in technology-driven growth, few names come to mind quicker than Invesco’s QQQ ETF. However, over the past few years, a newer and more cost-effective alternative has emerged—QQQM. This ETF has captured the attention of long-term investors, especially those focused on maximizing their returns while minimizing costs. With a dividend yield that’s steadily attracting attention, let’s explore why QQQM is a great option for your portfolio, particularly in terms of its dividends.

What is QQQM?

QQQM, or the Invesco NASDAQ 100 ETF, tracks the same index as the more widely known QQQ ETF—the NASDAQ 100. This index consists of 100 of the largest non-financial companies on the NASDAQ exchange, including tech giants like Nvidia, Microsoft, Apple, Amazon, and Google. While QQQM and QQQ are similar in their holdings and long-term performance, there’s one critical difference: QQQM has a lower expense ratio, making it a more cost-efficient option for long-term investors.

Why QQQM Dividend Yield Matters

The QQQM dividend yield is an attractive feature for investors seeking exposure to growth with a supplemental income stream. At the time of writing, QQQM’s dividend yield stands at 0.45%, which may seem modest compared to other dividend-heavy ETFs, but it’s an important factor to consider.

For growth-focused investors, the QQQM dividend yield provides a small, steady stream of income, while the real magic lies in the long-term capital appreciation that this ETF offers. Over time, reinvesting those dividends can compound returns, creating a powerful snowball effect.

QQQM vs. QQQ Dividend History: Which One Pays More?

A common question among potential investors is how QQQM compares to its older sibling, QQQ, in terms of dividends. While both ETFs track the same NASDAQ 100 index, QQQ has a slightly higher dividend yield at approximately 0.50%. However, this difference in yield is minimal, and the difference in expense ratios is more significant in the long run.

For example:

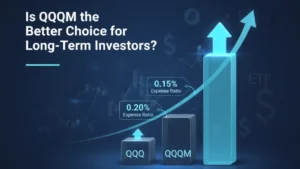

- QQQ Expense Ratio: 0.20%

- QQQM Expense Ratio: 0.15%

This small difference in expense ratios might not seem like much, but over the years, it can add up significantly, especially for those using a buy-and-hold strategy. Even with the slightly lower dividend yield, QQQM’s reduced fees allow long-term investors to maximize their net returns.

How QQQM Dividends Can Impact Your Investment Strategy

Investing in QQQM means exposure to the tech-heavy NASDAQ 100, which offers high growth potential. But for those who want to make the most of their investment, understanding the role of dividends is crucial. Here’s why QQQM’s dividends matter:

- Steady Income Stream: Although QQQM is primarily a growth-focused ETF, it does pay dividends. As tech companies, particularly those in the NASDAQ 100, continue to grow, the dividends paid out are often reinvested by investors to fuel further growth.

- Compounding Growth: Reinvesting dividends from QQQM over time can significantly increase your exposure to the NASDAQ 100. This is especially beneficial for younger investors with decades of investing ahead of them. The more you invest in QQQM, the more you benefit from its growing dividend payments, which compound over time

- Diversification Through Dividends: The dividends paid by QQQM come from companies across different sectors, though the focus remains heavily on tech. As companies in the index like Apple and Nvidia continue to grow, QQQM investors benefit from both price appreciation and those quarterly dividend payouts.

The Real Impact of QQQM Dividends on Your Portfolio

Consider this scenario: You invest $10,000 in QQQM. With a 0.45% dividend yield, your dividend payments will amount to about $45 per year. While this may not seem like much initially, over decades, those small dividends can compound into a substantial amount. By reinvesting those dividends into more QQQM shares, you can amplify the impact of your initial investment.

Additionally, dividends are a sign of a company’s financial health. For QQQM, these payouts come from some of the most well-established companies in the world, each showing consistent growth and the ability to generate profits. This provides a safety net for your portfolio even during volatile market conditions, making QQQM an attractive option for conservative investors who still want exposure to tech growth.

Is QQQM the Better Choice for Long-Term Investors?

For long-term investors who are looking to build wealth through both capital appreciation and dividends, QQQM is a smart option. While its dividend yield might not be as high as some other funds, its lower expense ratio and exposure to the fast-growing NASDAQ 100 make it an ideal choice for those who want to hold their investment for the long term.

The question, however, remains: Should you choose QQQ or QQQM?

If you’re a buy-and-hold investor focused on minimizing fees, QQQM should be your choice. It tracks the same index as QQQ but at a lower cost, which means more of your money is working for you over time. Additionally, QQQM’s dividends provide that extra layer of income to compound over the years.

Final Thoughts: QQQM Dividends and Long-Term Success

In summary, QQQM’s dividends might not be the highest in the market, but it offers consistent payouts from some of the most innovative companies in the world. Its lower expense ratio gives long-term investors a cost-effective way to maximize returns, while its dividends contribute to both income and compounding growth.

For those who believe in the continued rise of the technology sector and want to avoid high fees, QQQM offers an attractive balance between growth and dividends, making it a wise addition to any well-rounded portfolio. The QQQM dividend, although small now, could ultimately become a powerful driver of long-term wealth for patient investors.