Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

The Cony Dividend: What to Expect in 2025

The Cony dividend, tied to Coinbase’s performance, has been a subject of much speculation and intrigue among investors. With the rise and fall of cryptocurrency prices, particularly Bitcoin, many have been keenly watching how these fluctuations impact the yield and consistency of the dividend payments from the Cony dividend history. This blog post will explore Cony’s dividend trends, what might lie ahead, and whether it remains a reliable income source for investors.

What is the Cony Dividend?

Before diving into the specifics, let’s first understand the Cony dividend. Cony is a part of the YieldMax ETF portfolio, which actively manages call options on Coinbase shares, a leading cryptocurrency exchange platform. The fund’s goal is to provide high dividend yields to shareholders, capitalizing on volatility in Coinbase’s stock by generating income through option premiums. This strategy of selling calls on Coinbase stock is designed to provide investors with consistent income, while still allowing them to participate in any price increase of the underlying stock.

The Cony Dividend Yield: Is it Sustainable?

As of August 2025, the Cony dividend yield stands at an impressive 163.03%, based on Coinbase’s share price of $6.69. However, this yield is not without its concerns. While Cony dividends have been generous in the past, the volatility of Coinbase’s stock has led to some declines in the monthly dividend payments. For instance, in August 2025, the Cony dividend was down by 36.86% compared to the previous year, highlighting the impact of the fluctuating stock price on Cony dividend announcements.

Volatility and Risk: A Double-Edged Sword

The allure of the Cony dividend yield comes from its high payouts, but it comes with a significant amount of risk. With a beta of 2.01, Cony is more volatile than the broader market. This volatility is a direct result of the underlying asset—Coinbase—whose performance is heavily tied to the crypto market. If cryptocurrencies experience a bullish phase, Cony’s dividends may soar, but during bearish cycles, such as the current dip in Coinbase’s stock, the dividend payouts can shrink considerably.

Cony Dividend Suspended? The Worries of Investors

There are concerns that Cony dividends might be unsustainable in the long run. As Coinbase’s stock price has fallen significantly, the monthly payouts from YieldMax have decreased, leaving many investors questioning whether the fund can maintain its current payout rate. In 2025, the Cony dividend suspended scenario has become a possibility for many, especially considering the negative technical outlook and declining price of Coinbase’s stock.

However, despite these risks, Cony has maintained some level of consistency, especially in its distribution strategy. YieldMax has historically paid out between 43 cents and $2.79 per share monthly, with fluctuations in the market directly influencing these payments.

How Does the Cony Dividend History Impact Future Expectations?

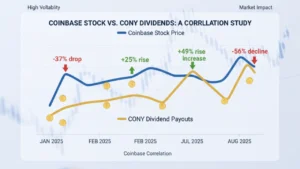

Looking at Cony dividend history, we see a pattern of significant fluctuations tied to the price volatility of Coinbase. For example, in January 2025, a decrease in Coinbase’s price led to a 37% drop in the distribution rate. On the flip side, in February 2025, a modest increase in Coinbase’s price resulted in a 25% rise in Cony’s payout. This highlights the close correlation between Coinbase stock fluctuations and the Cony dividend’s performance.

As the year progresses, investors should expect continued volatility in the Cony dividend payout as Coinbase’s share price remains unstable. As seen in July 2025, the Cony dividend increased by 49%, but by August 2025, it had decreased by 56% due to a 23% drop in Coinbase’s stock price.

Looking Ahead: Cony’s Next Dividend Date and Potential

For those wondering about the Cony next dividend date, investors should mark September 19 2025, on their calendars. Based on recent Coinbase price movements, we might expect the Cony dividend rate to fall between 25 and 40 cents per share for the upcoming payout. This estimate is based on the assumption that Coinbase’s price remains below its recent highs, but any positive movement could help stabilize the payout.

Key Takeaways for Investors

- Cony Dividend Yield: High but volatile, making it a risky income source.

- Coinbase’s Performance: Strong influence on the Cony dividend announcement.

- Dividend Suspended?: While not likely in the immediate term, investors should be cautious about the fund’s sustainability.

- Cony Dividend History: Fluctuates with Coinbase’s stock price, and recent trends suggest a downward trajectory.

Conclusion: Is Cony Still Worth It?

If you’re an investor looking for high-yield dividends, the Cony dividend may still offer attractive payouts. However, given the volatility of Coinbase’s stock, it’s crucial to balance the potential for high income with the risks of price erosion. For investors who can stomach the risk and are looking for speculative income, Cony dividends could still be an appealing option. On the other hand, if you prefer stability, you might want to look elsewhere.

Ultimately, whether or not to continue investing in Cony stock dividends will depend on your risk tolerance and belief in the future of Coinbase and the crypto market. The Cony ex dividend date in September will be crucial in setting expectations for the next payout.