Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

QDTE Dividend History: A Deep Dive into the High-Yield ETF’s Performance

In the world of high-yield investment strategies, one name has been rising above the crowd — QDTE. This innovative ETF, known for its impressive QDTE weekly dividend payouts, has been attracting the attention of income-focused investors. But, just how sustainable is this yield, and what should you know before diving into QDTE dividend history? Let’s explore how QDTE delivers its remarkable payouts and whether it’s the right fit for your investment strategy.

What Makes QDTE Stand Out?

QDTE, or the Roundhill Innovation 100 Days to Expiry Covered Call Strategy ETF, has made waves due to its high QDTE yield. The ETF is built around selling short-term call options (zero days to expiry or zero DTE options) on the NASDAQ 100 index, providing a unique way to generate income. The key here is the fund’s ability to harness the daily volatility of the market and turn that into regular, weekly dividends.

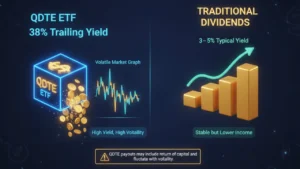

But how does QDTE maintain its remarkable dividend? The fund primarily makes money by selling out-of-the-money call options that expire every day, just before the market opens, and they expire by the end of the trading day. This strategy creates consistent premium income that is paid out to investors, which is a big draw for those seeking regular income. With a yield that hovers around 38% annually (as high as 44% in some reports), QDTE stock price has shown consistent movement alongside its dividend payouts.

The Mechanics Behind QDTE’s High Yield

The magic behind QDTE’s ability to pay such a high yield lies in its unique approach to options trading. Unlike most ETFs that might hold stocks and collect dividends, QDTE operates by selling covered calls on the NASDAQ 100 stocks. These options are sold every day, just before the market opens, and they expire by the end of the trading day.

However, it’s important to understand that QDTE’s impressive payout isn’t exactly “income” in the traditional sense. In fact, according to the fund’s own estimates, these large payouts are often a return of capital (ROC). This means that instead of receiving a slice of the fund’s profits, you’re simply getting some of your initial investment back. While this strategy defers tax liability and allows you to potentially lower your cost basis, it does raise important questions about the long-term sustainability of such a high payout.

How Does QDTE Compare to Traditional Dividends?

At first glance, QDTE’s 38% trailing distribution rate might look too good to be true. Traditional dividend-paying stocks or ETFs typically offer yields in the 3-5% range. By comparison, QDTE’s weekly payouts seem extraordinarily high. However, as we’ve noted, these payouts aren’t profits — they are a return of your own capital. This distinction is critical, as it means that, in the long run, your capital base may be eroded.

Additionally, QDTE total distributions fluctuate depending on market conditions. When the market is volatile and options premiums are high, QDTE can deliver substantial payouts. However, during calm, steady markets or when volatility drops, the payouts may shrink. Thus, while QDTE can provide an attractive weekly income stream, it’s important to understand that the payout is not guaranteed to remain consistent over time.

The Risk Factors: What Could Go Wrong?

While QDTE’s strategy of selling daily covered calls can generate substantial income, it’s not without its risks. First and foremost, there’s the potential for capital erosion. Since the fund is returning capital to investors, your cost basis is lowered with each payout, and once you sell the shares, the capital gain will be larger. This means higher taxes when you eventually sell, especially if you hold QDTE in a taxable account.

Another risk comes from the fund’s limited upside. Because it sells covered calls, the fund gives up any potential gains beyond the strike price of those options. So, in a rapidly rising market, QDTE stock price may not fully capture the growth of the NASDAQ 100. If the index rallies sharply, the fund’s performance will be capped, which may leave investors underwhelmed during bull markets.

QDTE Performance and How It Affects Your Portfolio

Looking at QDTE’s performance relative to its peers, it becomes clear that it’s not a one-size-fits-all solution. In markets where volatility is high, and the NASDAQ 100 is flat or only slightly rising, QDTE has performed well. The fund has shown solid returns, consistently paying out its weekly dividend with a yield of around 38%, even though the share price may fluctuate.

However, in strong, trending markets where stocks appreciate rapidly, QDTE struggles. The downside protection the fund offers via its covered call strategy limits the upside potential. In other words, while you’re getting consistent weekly payouts, you’re not likely to see major capital gains — especially during bull markets.

One of the key advantages of QDTE is its focus on the NASDAQ 100, a high-growth, tech-heavy index that can provide solid long-term returns. If you’re a long-term investor looking for growth, QDTE may not provide the capital appreciation you’re hoping for. However, if you’re seeking steady income and are comfortable with the risks associated with the return of capital, QDTE dividend history and performance could be a powerful tool to enhance your portfolio’s income stream.

Is QDTE Right for You?

QDTE is ideal for income-oriented investors who are seeking high QDTE weekly dividend payouts and are comfortable with the inherent risks of the strategy. It’s especially appealing to those who don’t mind the potential volatility and can tolerate the return-of-capital payouts. However, if you’re primarily focused on growth and want to capture the full upside of the NASDAQ 100, QDTE total distributions may not align with your investment goals.

Before diving in, ask yourself these important questions:

- Are you okay with the fact that the dividend is not a profit but a return of capital?

- How do you feel about the potential for NAV erosion over time?

- Are you prepared for the fact that weekly payouts may fluctuate depending on market conditions?

If you’re comfortable with these aspects, QDTE could be a great way to generate consistent income. But if you’re more focused on long-term growth, it might be worth exploring other options in the income ETF space.

QDTE Dividend

Final Words:

With its innovative zero DTE options strategy and consistent QDTE dividend payouts, QDTE stands out in the world of high-yield ETFs. However, it’s essential to understand the risks associated with this fund. While the yield is high, it comes at the cost of capital erosion, and the upside is limited by the covered call strategy. For investors seeking regular income and willing to accept some volatility, QDTE could be a solid addition to their portfolio. However, for those more interested in growth and long-term appreciation, it may be better to explore other options.

In the end, the decision to invest in QDTE comes down to your risk tolerance and income needs. It’s a powerful tool for income generation, but like any investment, it requires a clear understanding of how it works and where it fits within your broader financial goals.