Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

Texas Instruments: A Closer Look at Dividends, Cash Flow, and Future Prospects for Dividend Investors

When it comes to dividend growth investing, Texas Instruments (TXN) is often a name that gets brought up. Known for its steady TXN stock dividend increases over the years, the company has been a top choice for many dividend investors. But is it still the right pick in 2025? With recent changes in earnings, cash flow, and overall performance, should investors continue to bank on the TXN dividends for consistent returns? Let’s dive in and break down the situation.

Texas Instruments: A Dividend History Worth Noting

Texas Instruments has been a consistent dividend grower for over a decade. Historically, the company has raised its dividend by about 15% per year. This impressive growth, combined with a strong presence in industries like semiconductors, ensures that the company has the potential to reward long-term shareholders. The most recent TXN dividend date shows a starting yield of over 2.5%—a figure that may catch the attention of dividend-seeking investors. But here’s the catch: the company’s recent performance metrics raise some red flags.

The Current Situation: A Mixed Bag of Growth and Challenges

In 2025, Texas Instruments is facing a year of volatility, with its stock showing a decline of 13.6% over the past year and a 4.34% year-to-date drop. While this doesn’t reflect a great short-term outlook, historically speaking, Texas Instruments has been a solid performer, with its stock appreciating by about 285% over the last decade. What’s happening now, and why is TXN struggling?

A major factor lies in its financials. Over the past year, the company’s earnings per share (EPS) have declined sharply, from $9.51 in 2022 to $5.24 in 2023. Likewise, free cash flow (FCF) has followed a similar downward trend. In 2022, FCF per share was at $6.47, and by 2024, it had plummeted to just $1.64. Since dividends are paid out of free cash flow, this sharp decline raises concerns about the sustainability of the TXN stock dividend.

Is Texas Instruments’ Dividend Safe?

A critical question investors should be asking is whether the TXN dividend is still safe. The payout ratio—currently sitting at 100%—is concerning. This means Texas Instruments is using nearly all of its earnings to pay out dividends, with no room for reinvestment or a cushion for future economic challenges. Furthermore, the free cash flow payout ratio is more than 320%. This suggests that the company is spending far more than it’s earning in terms of cash flow.

This scenario is risky for dividend investors, as it places immense pressure on the company to continue generating strong cash flow in the future. So, what’s going on behind the scenes?

A Look Behind the Numbers: Management’s Capital Allocation Strategy

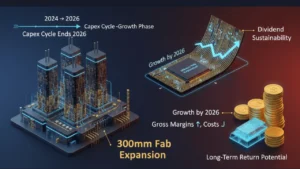

To understand what’s happening, it’s essential to look beyond the surface-level metrics. According to Texas Instruments’ management, the company is in the midst of a heavy capital expenditure (capex) cycle, which is significantly affecting its free cash flow. The company is investing billions of dollars into building new manufacturing plants and expanding its production capabilities. This is expected to position Texas Instruments for long-term growth, but it is putting a strain on the company’s free cash flow in the short term.

Texas Instruments’ management has made it clear that its focus is on long-term free cash flow growth, with projections suggesting that by 2026, free cash flow per share will start to recover. If these projections hold, Texas Instruments could return to its previous cash flow levels, and the TXN dividend could return to its historical growth trajectory.

A Dividend Increase in a Challenging Year

Despite these concerns, there’s some positive news for dividend investors. Texas Instruments recently announced a 4.4% dividend increase—while this is below their historical averages, it still shows the company’s commitment to rewarding shareholders. With a 10-year compound annual growth rate (CAGR) of 14.54% and a 5-year CAGR of 8%, Texas Instruments has demonstrated an ability to consistently increase its dividend.

For dividend investors looking for solid long-term growth, this TXN dividend hike, though modest, is an encouraging sign. Still, it’s essential to understand that future dividend growth may be slower than in previous years due to the ongoing investments and capital expenditures.

Texas Instruments’ Future Outlook: A Question of Capital Management

Looking to the future, Texas Instruments’ capital allocation strategy is key. The company’s leadership believes that its investments in manufacturing—especially its focus on moving from 200mm wafer fabs to 300mm fabs—will pay off in the long run by increasing gross margins and reducing costs. This, they believe, will position them for significant growth once their capital expenditures stabilize in 2026.

But while the projections are positive, they depend heavily on the company’s ability to execute its strategy. If the investment in new manufacturing plants doesn’t lead to the anticipated growth in free cash flow, the TXN stock dividend could come under pressure in the future.

Texas Instruments’ Dividend Valuation: What Does the Market Say?

As an investor, it’s also crucial to evaluate the stock’s current valuation. Texas Instruments’ stock has been down over the past year, and while it’s traded at a premium compared to its historical valuation, there’s still potential upside based on projected free cash flow recovery. In fact, if Texas Instruments can achieve its 2026 revenue and free cash flow targets, the stock could see a significant rebound. Some analysts are even projecting that the stock could appreciate by as much as 38% if the company hits its targets.

Still, much of the upside is built into the stock price already. The dividend discount model, which takes into account future dividend growth, suggests the stock could be worth around $191.31 per share, offering a modest upside from current levels. If the stock dips closer to $150 per share, it could become an attractive buy for long-term investors.

Key Takeaways for Dividend Investors

- Dividend Growth Is Slowing: While Texas Instruments has been a dividend growth powerhouse, recent challenges with free cash flow have led to slower dividend increases.

- Free Cash Flow Is Under Pressure: Heavy capital expenditures are affecting the company’s cash flow, which could impact the sustainability of the TXN dividend if things don’t improve by 2026.

- A Long-Term Play: If Texas Instruments’ investment in manufacturing pays off, the company could return to solid growth, leading to higher dividends and a stronger stock performance.

- Valuation Matters: Despite some short-term challenges, the stock may offer a good opportunity for long-term investors if it dips further.

Final Thoughts: Is TXN Stock a Good Buy?

For dividend investors, Texas Instruments remains a strong company with a solid track record of dividend growth. However, the company is facing some short-term challenges, particularly with its free cash flow. For those willing to take on a bit of risk and wait for the company’s investments to pay off, Texas Instruments could be a solid long-term play. But, if you’re looking for immediate dividend growth and stability, you may want to consider other options or wait for a better entry point.

![Is SCHD Dead Weight — Or the Ultimate Dividend Machine? [2025 Guide]](https://portfoliopayday.com/wp-content/uploads/2025/08/SCHD-Thumbnail-150x150.png)