Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

Pfizer Stock Split: What History and Predictions Reveal About the Future

In the world of investing, few names carry as much weight as Pfizer. Known for blockbuster drugs, billion-dollar acquisitions, and a dividend that continues to lure income investors, Pfizer has long been a household name on Wall Street. But for those asking whether a Pfizer stock split could be on the horizon, the answer requires diving into its past, its present struggles, and the predictions shaping its future.

This is not just a tale of numbers — it’s the story of a pharmaceutical giant navigating setbacks, acquisitions, and investor skepticism, while still holding onto the possibility of transformation.

A Stock That Refuses to Move

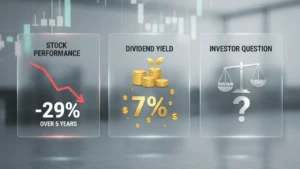

Investors often hope for inflection points, moments when a beaten-down stock suddenly reverses its trajectory. With Pfizer, those moments seemed imminent more than once — yet the turnaround never arrived. Over the past five years, Pfizer shares have fallen nearly 29%, underperforming the broader market.

For long-term holders, this has been painful. But it’s also what makes the Pfizer stock prediction story fascinating. While the price languishes, the dividend yield now hovers around 7%, making it one of the most attractive payouts in the sector. The question many are asking: is this sustainable, or is a cut inevitable?

The Dividend Question

A 7% yield would normally raise red flags. However, Pfizer’s free cash flow tells a different story. With yield coverage of roughly 65–68%, analysts suggest the dividend remains safe. The company expects free cash flow to rise from about $12 billion in 2025 to nearly $19 billion by 2027, thanks to cost-cutting, efficiencies, and the synergies from major acquisitions like Seagen.

This paints a picture where Pfizer’s dividend is not just sustainable, but possibly a cornerstone of its value proposition — especially in an environment of falling interest rates, where income stocks regain their shine.

The Shadow of Debt and Buybacks

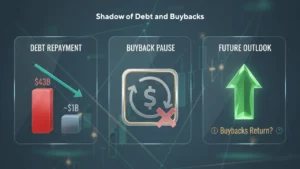

If Pfizer’s fundamentals are improving, why hasn’t Wall Street rewarded the stock? One answer lies in its lack of share buybacks. Despite trading at just eight times earnings — a deep discount compared to the industry average — Pfizer has avoided buybacks while paying down debt from its $43 billion Seagen acquisition.

That debt burden is now easing. With major repayments behind them and only about $980 million due by 2027, analysts speculate that Pfizer may soon reintroduce buybacks. History suggests this could be a powerful catalyst. Companies like British American Tobacco saw share prices rebound once buybacks returned, as investor confidence was restored.

Big Bets on the Future

Pfizer isn’t standing still. Beyond oncology, where its Seagen deal solidified a stronger presence, the company has set its sights on weight-loss treatments — a market projected to exceed $150 billion annually. While Pfizer faced setbacks with its own experimental drugs, it quickly pivoted by spending $7.3 billion to acquire Medsera, a biotech with early-stage obesity treatments.

This strategy echoes Pfizer’s long-term playbook: when patents expire and revenues decline, fill the pipeline through acquisitions and innovation. History shows that this cycle often precedes recovery — which ties back to the Pfizer stock prediction narrative.

Looking Back: Pfizer Stock Split History

Stock splits often symbolize corporate confidence and growth. For Pfizer, splits were more common in its earlier growth stages. Its last split occurred in 1999, when shares were booming on blockbuster drug launches and investor optimism.

Since then, the company has relied less on stock splits and more on dividends to reward investors. While a near-term split seems unlikely given today’s depressed share price, history reminds us that Pfizer has undergone transformational periods before — and could again. If the stock recovers to higher trading ranges, a Pfizer stock split might re-enter the conversation.

Why Analysts Remain Cautiously Optimistic

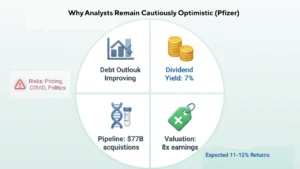

The story of Pfizer is complicated. Political headwinds, drug-pricing reforms, and declining COVID-19 vaccine sales weigh heavily. Yet fundamentals remain compelling:

- Dividend Yield: 7%, well-covered by free cash flow

- Valuation: Trading at a steep discount, just 8x earnings

- Pipeline: Oncology and obesity drugs, plus other acquisitions worth $77 billion since the pandemic

- Debt Outlook: Improving, opening the door for possible buybacks

Put together, the Pfizer stock prediction leans cautiously optimistic. Many analysts expect modest 11–12% annual returns over the next few years, even before factoring in multiple expansion. Should buybacks resume, returns could accelerate.

Investor Takeaway

For now, Pfizer is a stock defined by contradictions. Its price lags while its dividend thrives. Its debt weighed it down, but repayments are clearing a path to buybacks. Its weight-loss drug efforts stumbled, but acquisitions are creating fresh opportunities.

The Pfizer stock split history shows us that this company has reinvented itself before. Investors who are patient may once again see Pfizer rise, driven not by hype, but by fundamentals and long-term strategy.