Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

If you’ve been keeping an eye on CVS Health Corporation (CVS), you’re likely aware of its diversified approach in the healthcare space. From its network of pharmacies to its health insurance arm (Aetna) and its expanding role in healthcare services, CVS has grown to become more than just a drugstore chain. This article delves into the history of CVS’s dividends, including the ex-dividend date for 2025, its robust earnings performance, and what makes CVS a compelling choice for long-term investors.

What is CVS Health Corporation?

CVS Health has undergone significant evolution over the years, transitioning from a traditional retail pharmacy into a health powerhouse. The company operates in multiple sectors, including pharmacy services, retail, health insurance, and even urgent care centers. This diversification has enabled CVS to expand its revenue streams, maintain a competitive edge, and generate a healthy cash flow.

With its recent earnings announcement showing a stellar performance, CVS has garnered attention from both retail investors and institutional players. But what’s particularly interesting to note is the company’s dividend history and the role it plays in attracting income-seeking investors.

CVS Dividend History: A Reliable Income Stream

One of the major attractions of investing in CVS Health is its dividend history. The company has consistently paid dividends to its shareholders, offering a generous yield. As of 2025, CVS boasts a dividend yield of over 4%. This is quite appealing, especially in a volatile stock market where investors are increasingly looking for stable, income-producing assets.

CVS’s ability to pay such a dividend is rooted in its strong cash flow generation. The company’s free cash flow (FCF) in recent years has been robust, driven by its diversified business model. In the first half of 2025 alone, CVS generated $6.4 billion in cash from operations, with a relatively low capital expenditure (CapEx) figure of $1.3 billion. This left the company with more than $5 billion in free cash flow for the first half of the year, positioning CVS as a reliable income generator for its investors.

Ex-Dividend Date and Upcoming Dividends

If you’re looking to take advantage of CVS’s dividend payouts, it’s crucial to be aware of the company’s ex-dividend date. This is the cut-off date by which you must own the stock to be eligible for the upcoming dividend. For 2025, investors should keep an eye on the specific ex-dividend date, which will typically be announced in the company’s earnings reports or dividend declarations.

Given CVS’s consistent dividend payments, it’s no surprise that many investors keep their shares through these key dates, as the company’s yield continues to make it a reliable option for both growth and income.

Earnings Performance and Future Outlook

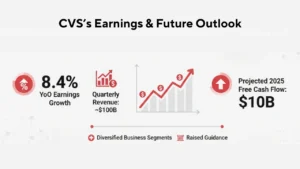

CVS’s strong performance has been a key factor in the positive sentiment surrounding its stock. The company recently reported an 8.4% year-over-year growth in earnings, totaling almost $100 billion in revenue for the quarter. This indicates not only strong top-line growth but also efficient operational management.

In 2025, CVS is expected to continue its upward trajectory, with projections for increased earnings per share (EPS) and continued growth in its diversified business segments. The company’s guidance for the year has been raised, with expectations that CVS will surpass earlier forecasts.

One of the most attractive features of CVS’s business model is its ability to generate consistent free cash flow. This is particularly important for sustaining the company’s dividend payouts. With a projected $10 billion in free cash flow in 2025, CVS is well-positioned to continue paying out dividends, all while funding growth and managing debt.

Why CVS Is a Safe Bet During Market Volatility

CVS’s diversification into health insurance, retail pharmacy, and healthcare services has made it a resilient stock, particularly in times of market volatility. For instance, during the sell-off in growth stocks earlier in 2025, CVS stood strong, showcasing its value as a hedge against more volatile sectors.

In terms of its stock price, CVS has also shown impressive performance, up 38% year-to-date and continuing to climb in pre-market trading. Investors seeking stability amid economic uncertainty are increasingly looking to CVS as a reliable player in the healthcare sector.

Is CVS a Good Buy in 2025?

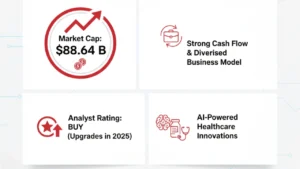

Looking ahead, the stock is expected to grow, thanks to its strong fundamentals, including its diversified business model and healthy cash flow. CVS’s market cap of $88.64 billion in 2025 positions it as a sizable player in the healthcare space, with plenty of room for expansion.

Analysts are bullish on CVS, with many upgrading its stock to “buy” and citing the company’s ability to recover and grow, especially after the challenges faced by its health insurance division (Aetna). Moreover, CVS’s ability to innovate, particularly in its AI-powered healthcare platform, is positioning it for long-term success.

Conclusion: The Future of CVS and Its Dividends

As we move into 2025, CVS Health remains a strong contender for both dividend-seeking investors and those looking for solid growth in the healthcare sector. The company’s history of reliable dividend payouts, coupled with its diverse business model and robust financials, makes it a solid investment choice for the long term.

Whether you’re focused on the CVS dividend history or looking to invest in the company’s future growth prospects, CVS continues to offer a compelling case. With its strategic expansions, strong cash flow, and promising outlook for 2025 and beyond, CVS is poised to remain a key player in the healthcare space.