Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

Novo Nordisk Stock: Buy or Sell? A Deep Dive into Its Future Prospects

Novo Nordisk, a global leader in diabetes and obesity care, has seen a tumultuous stock performance in 2025. With its groundbreaking GLP-1 drugs like Ozempic and Wegovy making waves in the healthcare market, many investors are left wondering: Is this the right time to buy or sell Novo Nordisk stock? In this article, we’ll take an in-depth look at the company’s current position, its challenges, and its future potential.

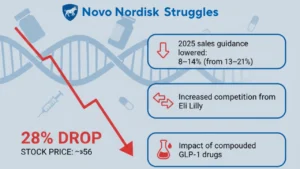

The Stock Struggles: A Market Downturn

As of September 2025, Novo Nordisk stock has experienced a significant decline, down approximately 28% year-to-date, with its stock price hovering around $56. Despite the company’s promising product lineup, including the highly anticipated weight loss pill, the stock’s performance has not met investor expectations.

The reason? Multiple factors are at play. A significant cause of concern is the company’s lower-than-expected guidance for 2025. Novo recently revised its sales growth forecast, lowering it from 13-21% to a more modest 8-14%, citing challenges such as lower-than-expected growth in the US obesity market and increased competition from Eli Lilly. Additionally, the continued use of compounded GLP-1 drugs has hurt sales, as these cheaper, non-branded versions compete directly with Novo’s premium products.

The GLP-1 Battle: Competition and Regulation

At the heart of the stock’s struggles is the ongoing battle between Novo Nordisk and Eli Lilly in the GLP-1 drug market. While Novo has been the leader in this space with drugs like Ozempic and Wegovy, Eli Lilly is quickly catching up with its own weight loss treatments. Eli Lilly’s Zepbound has shown superior results in clinical trials, which is putting pressure on Novo’s market share. As of now, Novo holds around 52% of the GLP-1 market, but this could shrink further as competition intensifies.

Furthermore, the US FDA’s stance on compounded GLP-1 treatments has created uncertainty. Novo is pursuing legal action against companies like Hims, which have been able to sell cheaper, compounded versions of its treatments. While this litigation could potentially boost Novo’s fortunes, it’s expected to take time, and investors are wary of waiting for a resolution.

Catalysts for Growth: The Weight Loss Pill and New Approvals

Despite the current headwinds, there are positive developments on the horizon that could turn the tide for Novo Nordisk stock. First, the company is nearing approval for an oral version of Wegovy, a drug that has already proven highly effective for weight loss. If Novo becomes the first to launch an oral GLP-1 pill, it could tap into a much larger market of consumers who prefer pills over injections, which could provide a significant revenue boost.

Moreover, Novo’s focus on expanding into international markets and targeting obesity and diabetes patients in the US and abroad remains strong. There’s a massive addressable market—over 1 billion people globally suffer from obesity, and a growing number are seeking treatment. If Novo can secure a dominant position in these markets, it could see substantial long-term growth.

Financials: Is Novo Nordisk Undervalued?

When evaluating whether Novo Nordisk is a buy or sell, it’s crucial to consider its financial health. Despite the stock’s recent dip, Novo remains a cash-generating powerhouse. In its latest quarterly earnings report, the company announced a 16% increase in sales, with obesity care revenue rising by 56%. Additionally, its dividend policy remains strong, with consistent growth in payouts—a key consideration for income-focused investors.

Novo’s discounted cash flow (DCF) analysis suggests the stock is significantly undervalued. The intrinsic value per share is calculated at $137, compared to the current market price of around $56. This makes the stock an attractive opportunity for long-term investors, especially considering its low price-to-earnings (P/E) ratio of 15.79, which is well below the healthcare sector’s average.

Stock Split and Dividend Prospects

Novo Nordisk also has a history of dividend growth, with its payouts increasing at an impressive rate over the past five years. As of now, the stock offers a yield of around 3%, with analysts projecting continued dividend growth. This is an important consideration for those looking for a reliable income stream.

A potential stock split could also be in the cards, especially given the company’s market cap and low stock price. A stock split would make shares more accessible to smaller investors, potentially boosting demand and providing a positive catalyst for stock price appreciation.

Is Novo Nordisk Stock a Buy or Sell?

With all the information at hand, is Novo Nordisk stock a buy or sell? The answer isn’t straightforward, but for investors with a long-term perspective, the stock appears to be undervalued and presents a compelling buying opportunity. The challenges it faces, from increased competition to regulatory hurdles, are significant, but they also offer a chance for investors to enter at a low price before potential catalysts, such as the oral weight loss pill and a resolution of legal disputes, take effect.

For those seeking short-term gains, the volatility in the stock may be a cause for concern, especially with the stock currently in a consolidation phase. However, with its strong product lineup, solid financials, and significant market potential, Novo Nordisk is well-positioned for future growth.

Conclusion: Patience Could Pay Off

In conclusion, while Novo Nordisk stock faces some hurdles in the short term, its long-term growth prospects, particularly in the weight loss and diabetes care sectors, make it an attractive buy at current prices. Investors looking for value and willing to be patient may find that the company’s stock is poised for a rebound, especially once the oral weight loss pill and legal battles are resolved.