Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

Understanding the GPIQ Dividend History: Growth and Income in One ETF

When you’re looking to invest in an ETF, particularly one tied to the NASDAQ 100, the decision often comes down to whether you want growth, income, or both. Two prominent ETFs that frequently appear in discussions are JEPQ and GPIQ, both of which provide dividend-based income. However, they approach dividend generation in a different manner. While JEPQ offers long-term growth with a more passive income stream, GPIQ provides a more aggressive strategy aimed at both consistent income and growth. But which is better for you? Let’s dive into the GPIQ dividend history and see how this ETF stands out.

What Makes GPIQ Different?

GPIQ, or the Goldman Sachs NASDAQ 100 Premium Income ETF, was launched in late 2023 and is designed to deliver substantial monthly income, using a dynamic call option strategy. This allows it to generate income from the NASDAQ 100 while still leaving room for capital appreciation. The ETF primarily invests in high-growth tech stocks like Apple, Microsoft, and Nvidia, and its covered call strategy offers a monthly distribution yield of approximately 10%.

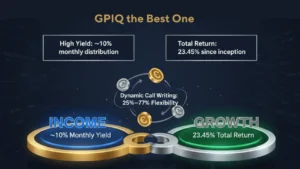

Unlike other covered call ETFs that sell calls on 100% of their portfolio, GPIQ uses a more flexible approach, dynamically choosing the portion of assets to write calls on (typically between 25% to 75%). This strategy aims to strike a balance between generating income today and allowing the fund to appreciate when the market is favorable.

GPIQ Dividend History: A Strong Start

Since its launch in October 2023, GPIQ has provided strong returns and consistent dividend payments. As of the latest data, its monthly distribution yield stands at around 10%, making it an attractive option for investors looking for steady income streams. Over the past year, GPIQ has delivered a total return of 23.45%, outpacing some of its competitors, including JPEQ and QQQI, which have yielded slightly lower returns.

Key Dividend Data:

- Dividend Yield: Approximately 10%

- Total Return (since inception): 23.45%

- Monthly Distribution: Around 39-43 cents per share

- Assets Under Management (AUM): Over $1.5 billion

This combination of high yield and capital appreciation makes GPIQ a strong contender in the realm of covered call ETFs.

Why GPIQ’s Strategy Works

The strategy behind GPIQ is quite different from traditional income-focused ETFs. By dynamically managing its options, it can adjust its call-writing percentage depending on the market conditions. For example, if the tech sector is booming, GPIQ may write fewer calls to capture more of the upside. On the other hand, if the market is flat or bearish, it may increase its call-writing to generate more income.

This flexibility provides an advantage over ETFs that use static covered call strategies, like QYLD, which caps upside growth by consistently writing calls on 100% of the portfolio. By doing so, GPIQ allows for better participation in tech rallies, offering a balance between growth potential and income generation.

GPIQ Dividend History vs. JEQ: What’s the Difference?

While GPIQ aims to balance growth and income, JEPQ (JP Morgan Equity Premium Income ETF) focuses more on long-term growth. JEPQ offers a lower yield of 9.72%, but it has a higher total return of 22.95%, slightly surpassing GP IQ. The main difference here lies in the strategies:

- JEPQ sells out-of-the-money (OTM) calls, allowing for more growth potential but with a lower immediate income.

- GPIQ, on the other hand, sells at-the-money (ATM) calls, providing a higher yield but at the cost of some future capital appreciation.

If your priority is immediate income, GPIQ offers a stronger option with its higher yield. However, if you’re looking for long-term growth with a smaller immediate payout, JEQ might be the better choice.

GPIQ: The Best of Both Worlds

GPIQ shines in its flexibility—allowing investors to enjoy steady income from covered calls while still leaving room for the fund to grow. For investors seeking a balance of both steady income and the potential for capital appreciation, this ETF delivers a winning combination. Here’s a recap of why GPIQ stands out:

- Dynamic Call Writing: Unlike traditional covered call ETFs, GPIQ adjusts the percentage of assets it writes calls on, allowing for more upside potential during market rallies.

- High Yield: With a yield of 10%, it offers one of the highest monthly distributions in the market.

- Total Return: GPIQ has delivered a total return of 23.45% since inception, outpacing some of its competitors.

- Tax Efficiency: Most of its distributions are returns of capital, which aren’t taxed immediately, providing significant tax advantages.

GPIQ Dividend History: What’s Next?

Looking ahead, GPIQ‘s dividend history is still evolving, but its strong performance and dynamic strategy make it a promising option for investors focused on both income and growth. However, as with any investment, it comes with risks, particularly because it relies on tech concentration and covered calls.

For those seeking a diversified approach to income generation, GPIQ offers a powerful solution, especially for those who want to participate in the tech sector without sacrificing monthly income.

Conclusion: Is GPIQ Right for You?

If you’re looking to enhance your portfolio with a high-yield ETF while still enjoying potential growth from the tech sector, GPIQ might be your answer. Its dynamic approach to covered calls provides both steady income and upside potential, making it a strong contender for any dividend-focused investor.

As always, the key to successful investing is aligning your choices with your financial goals. Whether you’re after high income today or long-term growth, choosing the right ETF for your needs will set you on the path to achieving your financial freedom.