Disclaimer: The following is for informational purposes only and not financial advice. Always do your own due diligence. I am not a licensed advisor.

VGT Dividend Yield: Should You Invest in Vanguard’s Information Technology ETF

If you’re looking to invest in technology-focused ETFs, Vanguard’s VGT (Vanguard Information Technology ETF) might have caught your eye. This ETF provides exposure to some of the best-performing technology stocks on the market, including Apple, Microsoft, and Nvidia. But does it provide a good dividend yield? And how does it compare to other ETFs like QQQ? In this article, we’ll break down the VGT dividend, its yield, and how it compares to other tech ETFs, such as QQQ, to help you decide if this ETF is the right choice for your portfolio.

Does VGT Pay a Dividend?

One of the most common questions investors have about the Vanguard Information Technology ETF (VGT) is whether it pays a dividend. The answer is yes! VGT does indeed offer dividends, typically distributed quarterly. While VGT’s dividend yield hovers around 0.51% to 0.52%, it provides a consistent income stream for investors. The yield may not seem huge, but when you’re investing in a growth-focused ETF, dividends serve as an additional benefit, alongside the potential for capital appreciation.

VGT Dividend Yield: A Good Investment for Income?

VGT’s dividend yield typically ranges between 0.51% and 0.52% annually. This yield gives investors an idea of the return from dividends alone, though it is on the lower side compared to other dividend-focused ETFs. While it doesn’t provide as high a yield as some dividend ETFs like SCHD or VYM, it does offer a steady income stream from top-tier tech companies.

Important Note: To receive the VGT dividend, you need to own the ETF shares before the X dividend date. After this date, the dividend payment is usually made shortly thereafter. Staying informed about these dates can help you maximize your dividend income.

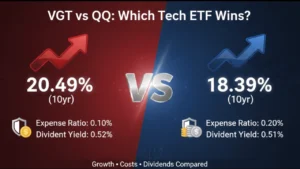

VGT vs QQQ: Which Tech ETF Offers Better Returns?

When comparing VGT to another popular tech ETF, QQQ (Invesco QQQ Trust), there are several key differences to consider:

- Performance: Over the past decade, VGT has consistently outperformed QQQ. VGT’s 10-year performance is 20.49%, while QQQ’s is 18.39%. This shows VGT’s stronger growth potential in the tech sector.

- Expense Ratio: VGT has a lower expense ratio of 0.10%, meaning you pay only $10 per year for every $10,000 invested. In contrast, QQQ’s expense ratio is 0.20%, doubling the cost.

- Dividend Yield: VGT typically offers a slightly higher dividend yield than QQQ. As of 2025, VGT’s yield is 0.52%, while QQQ’s is slightly lower at 0.51%. However, both yields are modest compared to dividend-heavy ETFs.

For a more in-depth look at the QQQ dividend yield and how it compares to other ETFs, check out our detailed analysis of the QQQ dividend

How Does VGT’s Dividend Yield Compare to Other ETFs?

When looking at VGT vs QQQ, the dividend yield is important, but it isn’t the only factor in making an investment decision. Compared to other dividend ETFs like SCHD or DGRO, VGT’s yield is lower. However, its focus on technology provides exposure to high-growth companies, which could boost your total returns in the long term.

Pros of VGT

- High Growth Potential: VGT’s technology-heavy portfolio offers exposure to some of the most innovative and rapidly growing companies in the market, including Apple, Microsoft, and Nvidia.

- Steady Dividend Payments: VGT pays quarterly dividends, offering a small but reliable source of income for long-term investors.

- Low Expense Ratio: With an expense ratio of just 0.10%, VGT is more cost-effective than other tech-focused ETFs like QQQ, making it an attractive choice for investors looking to minimize fees.

Cons of VGT

- Low Dividend Yield: While the dividend yield for VGT is reliable, it’s not the highest in comparison to other dividend ETFs. If you’re focused on maximizing income from dividends, you might want to explore alternatives like SCHD.

- Heavy Concentration in Tech Stocks: VGT’s top 10 holdings make up over 60% of the fund, with a heavy focus on companies like Apple, Microsoft, and Nvidia. While these are strong companies, such a high concentration could increase risk if the tech sector faces a downturn.

Risks and Drawbacks of VGT

Despite its impressive growth potential, VGT does come with some risks. The high concentration in the top 10 tech companies means that if one of these giants faces a downturn, the whole ETF could take a hit. Additionally, VGT might not be as diversified as some other ETFs, which could be a concern for investors looking for a broader portfolio spread across multiple sectors.

The expense ratio of 0.10% is also relatively low compared to other ETFs, but it’s still important to keep in mind when making long-term investments. For investors looking for even cheaper options, ETFs like FTEC or SCG may provide similar exposure to the tech sector with lower fees.

Should You Invest in VGT?

If you’re looking for exposure to the tech sector with the bonus of dividend income, VGT could be an excellent addition to your portfolio. While it may not offer the highest dividend yield compared to other ETFs, its strong performance and low expense ratio make it an attractive long-term investment for those focused on growth.

For investors seeking broader tech exposure with stable, consistent returns, VGT offers a compelling option. However, if you’re looking for higher dividend yields, it might be worth considering other options like SCHD or DGRO.

Ultimately, the choice between VGT and other ETFs like QQQ depends on your investment goals—whether you prioritize growth, dividends, or diversification.